Afterpay, known for its convenient installment plans and interest-free payments, has gained significant popularity among consumers. It provides a seamless payment option that allows customers to split their purchases into manageable installments. However, it is worth noting that there are several other mobile applications similar to Afterpay that offer comparable services and benefits, catering to the diverse needs and preferences of consumers. These alternative apps provide users with the flexibility to spread out their payments while enjoying the convenience and ease of online shopping. Exploring these options can empower consumers to make informed decisions and choose the payment solution that best aligns with their individual financial circumstances and preferences. Here are the top 10 apps like Afterpay that you should know about.

Top 10 Best Apps like Afterpay in 2026

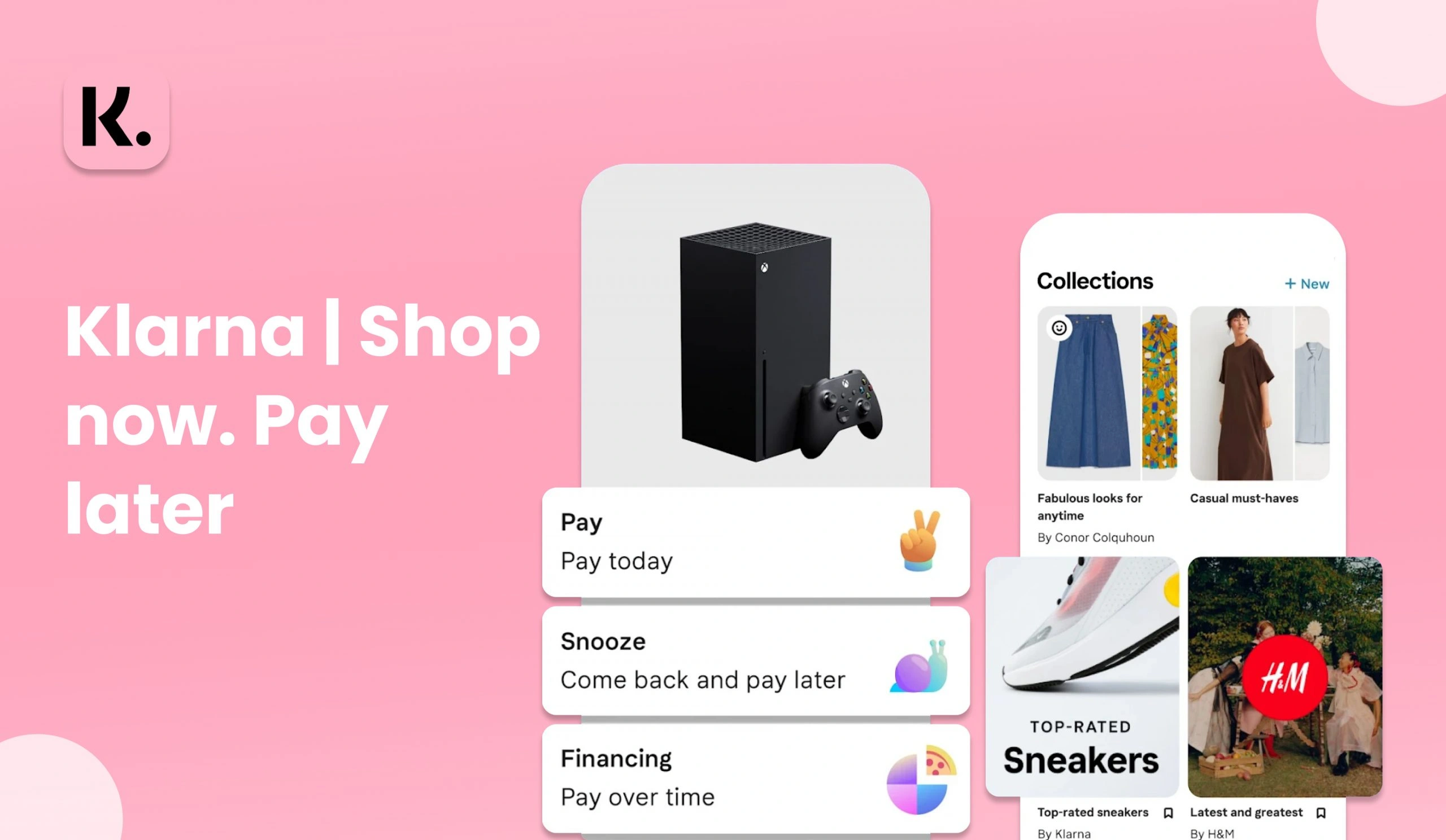

1. Klarna: Similar to Afterpay

Klarna, a leading competitor of Afterpay, is renowned for its exceptional services in the buy now, pay later space. With its wide global reach, Klarna allows users to split their purchases into four convenient interest-free installments. But that’s not all! Klarna also offers a range of additional features, including price-drop alerts, virtual credit cards, and rewarding loyalty programs, making it a comprehensive and customer-centric platform.

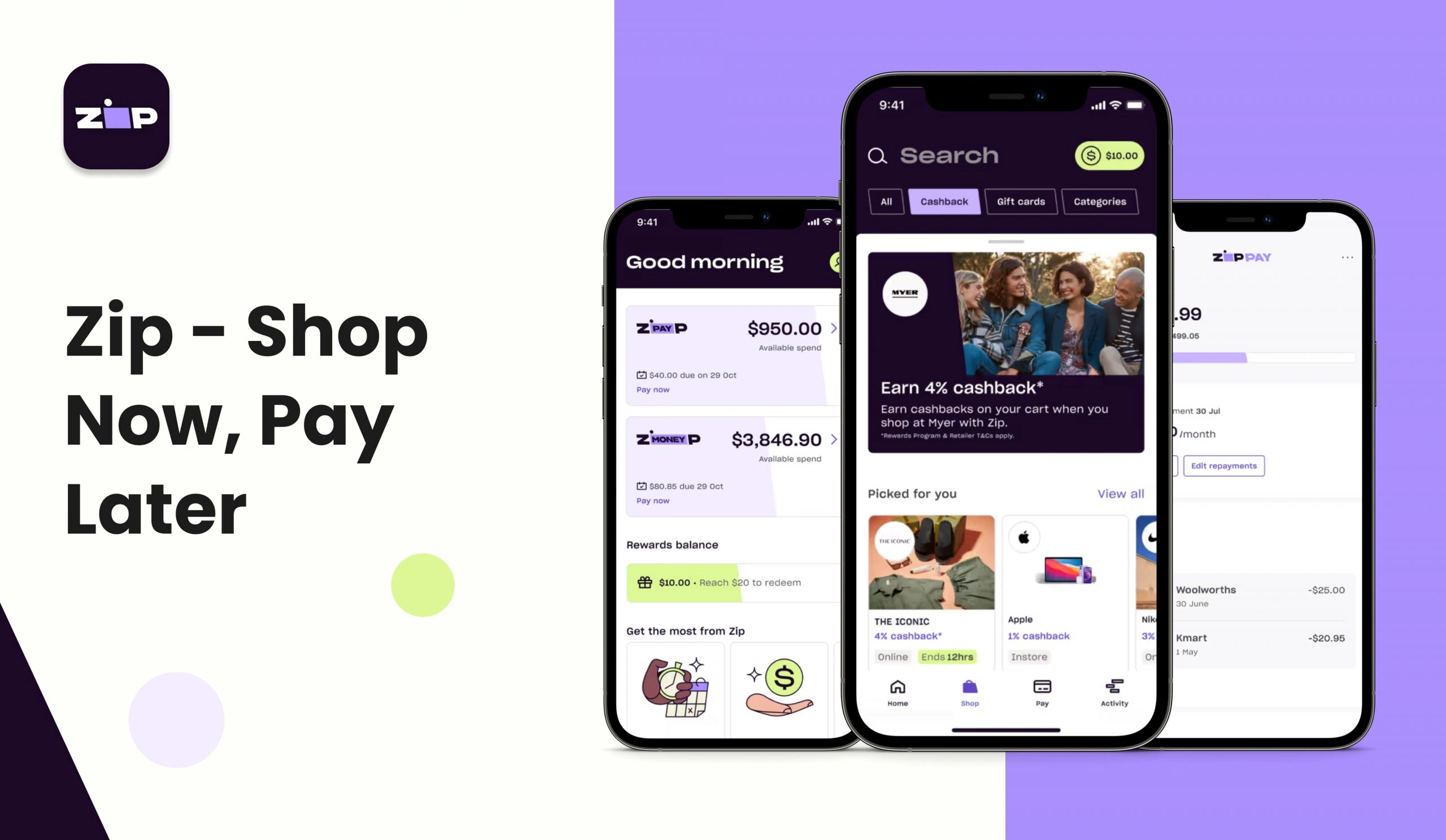

2. ZipPay: Sites Like Afterpay

ZipPay, another app following a similar concept to Afterpay, empowers users to pay for their purchases in four interest-free installments. Beyond its core functionality, ZipPay also boasts a user-friendly digital wallet feature and seamless payment support for various online stores. With ZipPay, users can enjoy a hassle-free shopping experience while managing their finances smartly.

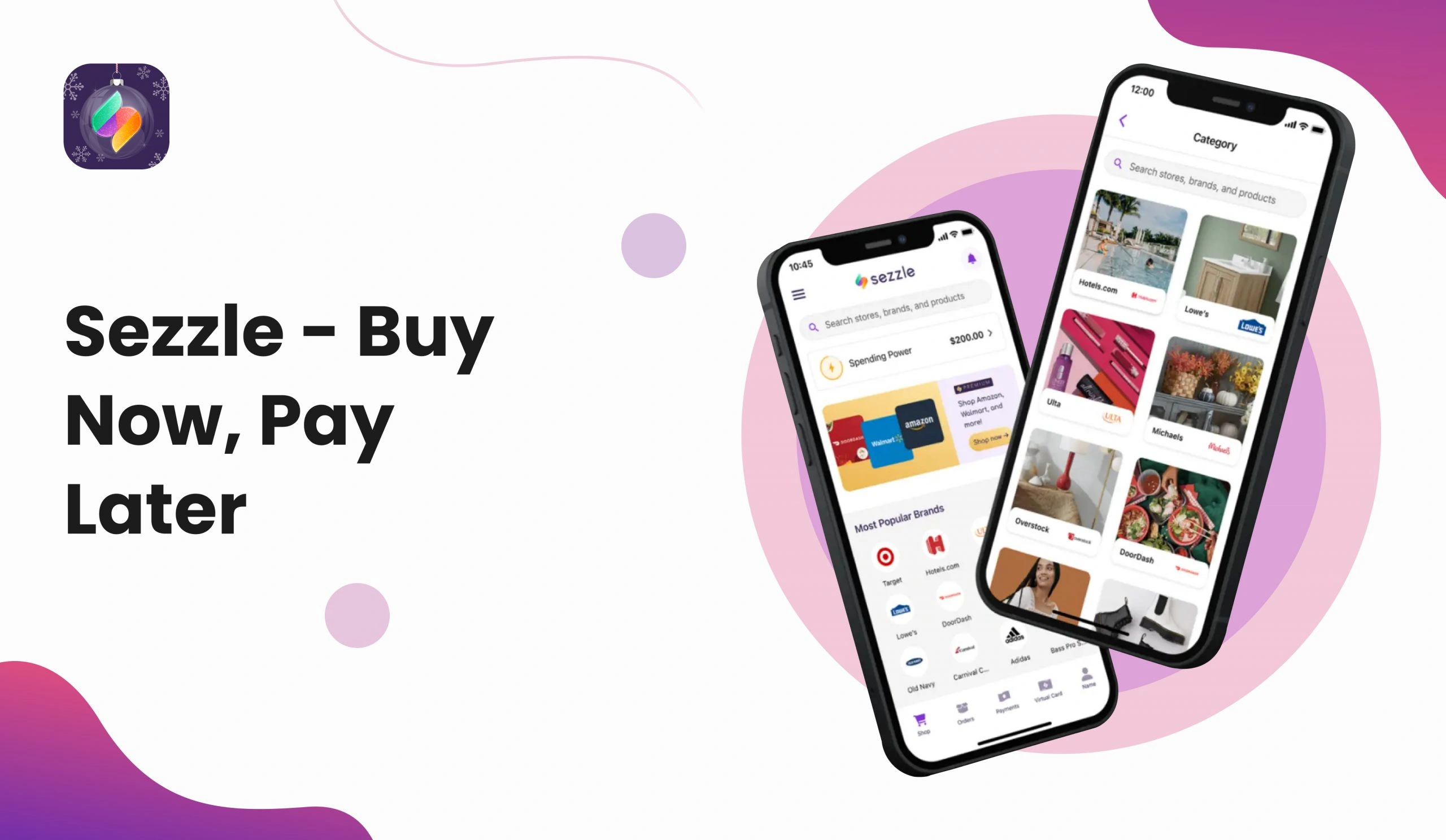

3. Sezzle: Afterpay Alternative

Sezzle, a popular alternative to Afterpay, primarily operates in the US, Canada, and Australia. It offers users the flexibility to split their purchase into four equal installments, without imposing any interest or additional fees. What sets Sezzle apart is its unique “Shop Now, Pay Later” feature, which allows users to make purchases at any online store and conveniently pay later in four installments. Sezzle puts the power of financial control in users’ hands.

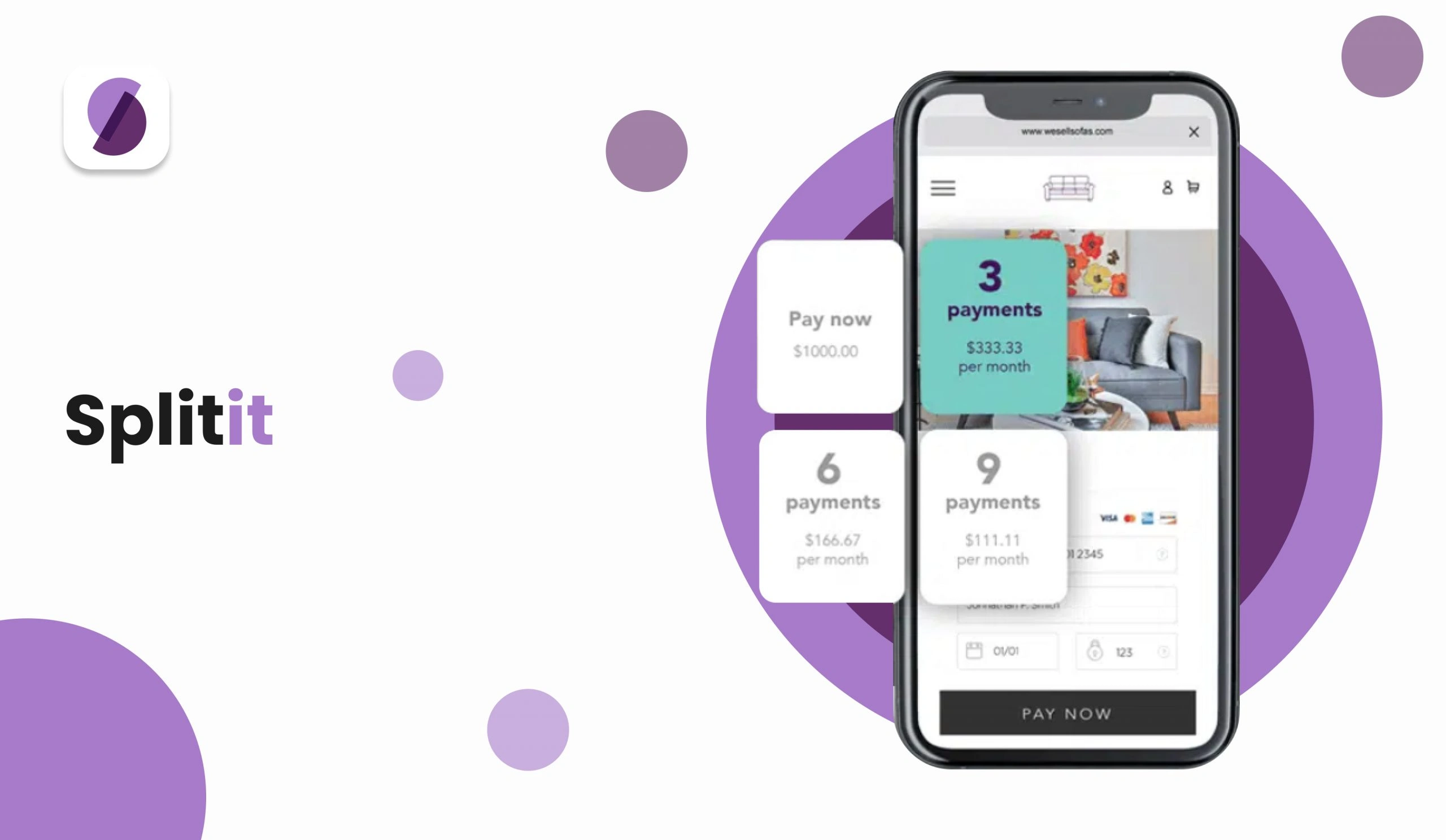

4. Splitit: Apps Like Afterpay

Splitit presents an innovative approach to payment flexibility, enabling users to split their payments into smaller and manageable installments by utilizing their existing credit or debit cards. With Splitit, users can enjoy the convenience of paying over time without incurring any interest or fees. While the service may require a credit check, Splitit opens up a world of possibilities for users to manage their expenses wisely.

5. QuadPay: Similar to Afterpay

QuadPay stands as another reliable app offering buy now, pay later services through four interest-free installments. With a vast network of partnered retailers, QuadPay provides users with a seamless experience and also offers the convenience of splitting purchases at any store using the virtual card feature. QuadPay empowers users to shop with confidence while maintaining financial control.

6. Humm: Sites Like Afterpay

Humm, an Australian-based app, takes the buy now, pay later experience to new heights. Offering services in five equal installments, Humm caters to users’ needs for larger purchases such as furniture or electronics by allowing them to split payments into ten or even twenty installments. With Humm’s exclusive “Big Things” feature, users can make significant purchases while maintaining financial stability.

7. Payright: Afterpay Alternative

Payright, an app similar to Afterpay, specifically targets the home and lifestyle industries. It offers users the flexibility to split purchases into three, six, or twelve payments without imposing any interest or fees. Additionally, Payright provides users with a virtual card for in-store purchases, ensuring a seamless and convenient shopping experience for users across various industries.

8. Paypal Credit: Apps Like Afterpay

Paypal credit is another app like Afterpay that allows users to make purchases and pay over time, with the added benefit of no interest for six months on purchases over $99. With a simple application process and no annual fees, Paypal credit is an excellent option for those looking to finance larger purchases without incurring any additional costs. Additionally, Paypal’s extensive network of partnered merchants provides users with a wide range of options for their shopping needs.

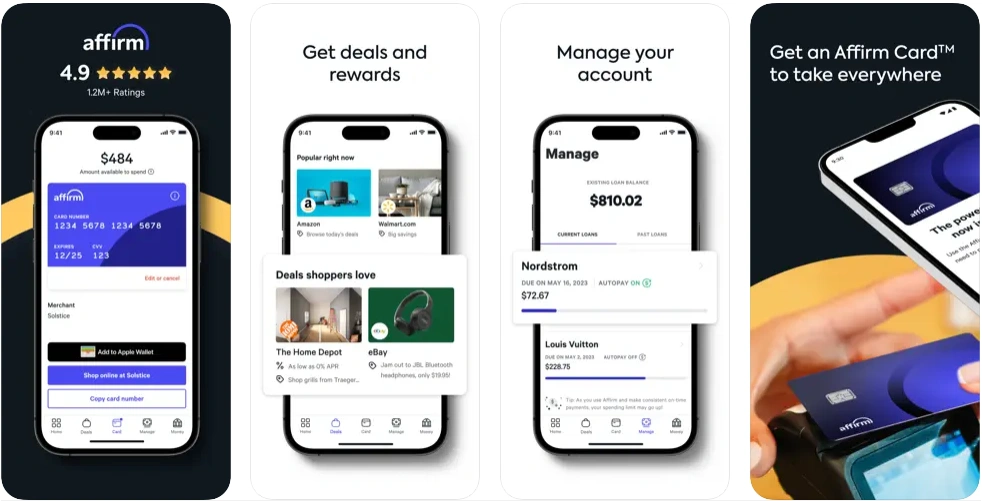

9. Affirm: Similar to Afterpay

Affirm offers similar services to Afterpay, with the added benefit of no late fees or hidden charges. With a simple interest rate and transparent payment plans, Affirm empowers users to make informed financial decisions while providing them with the flexibility to split purchases into multiple installments. Moreover, Affirm’s partnerships with various retailers allow users to access a wide range of products and services through their app.

10. Go Cardless: Sites Like Afterpay

Go Cardless offers a unique payment solution by allowing users to make payments via direct debit. With GoCardless, users can schedule recurring payments or pay in installments for larger purchases without worrying about manual payments. This app is particularly beneficial for those with fluctuating income or those seeking to streamline their finances with automated payments. Additionally, Gocardless user-friendly interface and efficient payment process make it a popular choice among users.

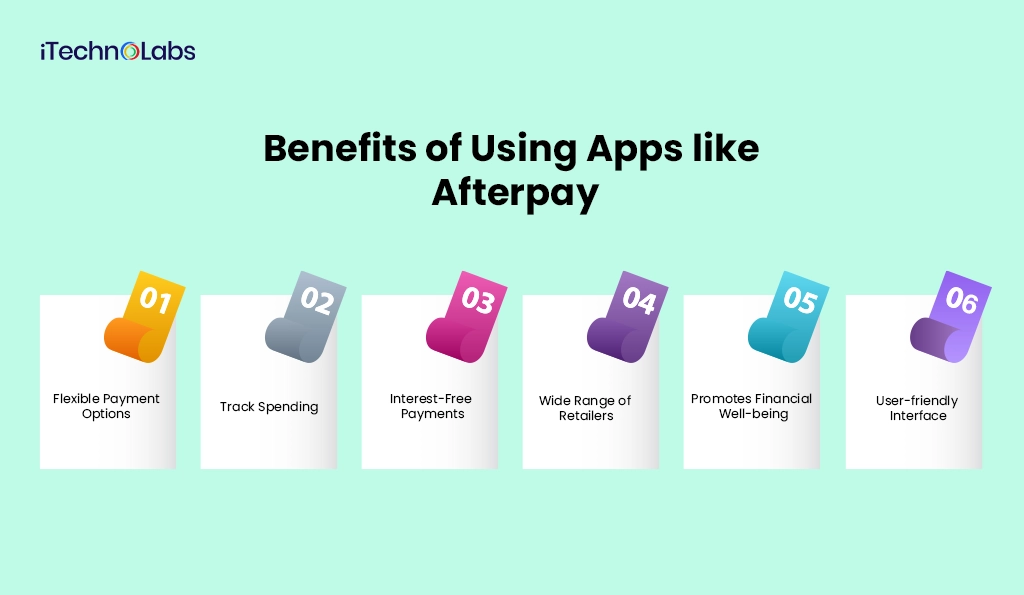

Benefits of Using Apps Like Afterpay

Apps like Afterpay provide users with a convenient and flexible payment solution that allows them to manage their finances effectively. Users can make purchases without having to pay the full amount upfront, making it easier to budget expenses over time. Moreover, these apps often offer zero or low-interest rates, making it financially feasible for users to shop within their means while avoiding additional costs.

With Afterpay, users can also enjoy the option of splitting their payments into multiple installments, providing even greater flexibility. This means that big-ticket items or unexpected expenses can be spread out over several weeks or months, alleviating the burden on users’ budgets. Additionally, Afterpay allows users to track and monitor their payment schedules, ensuring that they stay on top of their financial commitments.

Furthermore, Afterpay offers a seamless and user-friendly experience, with a simple sign-up process and intuitive interface. Users can easily browse and discover a wide range of retailers and online stores that accept Afterpay, expanding their shopping options. The ability to shop now and pay later empowers users to make purchases that they may have otherwise postponed, enhancing their overall shopping experience.

In summary, apps like Afterpay not only provide a convenient and flexible payment solution but also offer additional benefits such as the ability to split payments, track payment schedules, and explore a variety of retailers. By enabling users to better manage their finances and shop within their means, Afterpay enhances the overall shopping experience and promotes financial well-being.

- Flexible Payment Options: Apps like Afterpay allow users to split their purchases into smaller, manageable payments, providing financial flexibility.

- Track Spending: These apps offer tracking features, enabling users to monitor their spending habits and manage their budgets effectively.

- Interest-Free Payments: Many of these apps offer zero or low-interest rates, making purchases more affordable over time.

- Wide Range of Retailers: Users can shop from a multitude of retailers and online stores that partner with apps like Afterpay, expanding their shopping options.

- Promotes Financial Well-being: By facilitating manageable payments and promoting responsible spending, apps like Afterpay contribute to better financial health.

- User-friendly Interface: These apps offer a seamless and intuitive user experience, making it easy for users to navigate and manage their account.

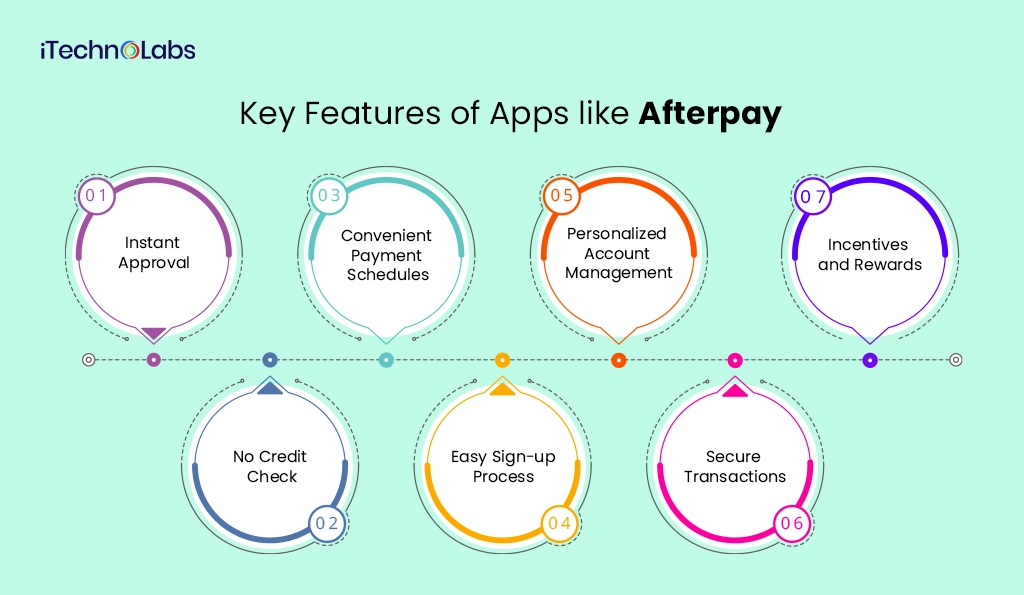

Key Features of Apps Like Afterpay

- Instant Approval: Many of these shopping apps offer instant approval for users, eliminating the need for lengthy credit checks or waiting periods. With just a few simple steps, users can quickly gain access to a wide range of products and services.

- No Credit Check: Unlike traditional credit cards that require a thorough credit check, apps like Afterpay provide a more inclusive and accessible option for users. By removing this requirement, individuals with limited credit history or lower credit scores can still enjoy the benefits of convenient shopping.

- Convenient Payment Schedules: These shopping apps go beyond the typical payment options by allowing users to select their preferred payment schedule. Whether it’s weekly, bi-weekly, or monthly installments, users have the flexibility to align their payments with their personal financial situation and budget.

- Easy Sign-up Process: Signing up for apps like Afterpay is a seamless and hassle-free experience that can be completed in just a few minutes. With intuitive interfaces and clear instructions, users can easily create an account, providing them with immediate access to a world of shopping possibilities.

- Personalized Account Management: These shopping apps empower users to personalize their account settings and payment plans according to their unique needs and preferences. From adjusting payment dates to setting spending limits, users have the freedom to tailor their shopping experience to suit their lifestyle.

- Incentives and Rewards: To enhance the shopping experience, many of these apps offer enticing rewards and incentives. Users can enjoy discounts, cashback rewards, or exclusive offers, adding extra value to their purchases and making their shopping experience even more enjoyable.

- Secure Transactions: With robust security measures in place, users can shop with confidence, knowing that their personal and financial information is protected. These shopping apps utilize secure payment systems and advanced encryption technologies to ensure that transactions are safe and secure, providing users with peace of mind throughout their shopping journey.

Overall, apps like Afterpay have revolutionized the way consumers shop by providing a convenient and responsible alternative to traditional credit cards. With their user-friendly interface, flexible payment options, and focus on promoting financial well-being, it’s no surprise that these apps have become increasingly popular in recent years.

What is the cost procedure of apps like Afterpay?

The cost procedure of apps like Afterpay varies depending on the specific app and its features. Generally, there are no fees associated with using these shopping apps to make purchases. However, users may be charged interest if they do not pay off their balance within the designated time frame or if they opt for installment plans with fees.

In terms of setting up an account, most apps like Afterpay do not require any fees or minimum balance. Users simply need to download the app and provide their personal and payment information to start using it.

Some apps may offer optional premium features for a cost, such as increased rewards or higher limits for purchases. However, these features are not necessary to use the app and can be chosen at the user’s discretion.

The cost procedure of apps like Afterpay typically involves the following steps:

- Download the App: To get started, users need to visit their mobile device’s app store and download the desired app. Most apps, like Afterpay, can be downloaded for free. Simply search for the app in the app store, tap on the “Download” button, and it will be installed on your device.

- Create an Account: After downloading the app, users will need to create an account. This usually involves providing some personal information, such as your name, email address, and phone number. Additionally, you may be asked to provide details about a valid payment option, such as a credit card or bank account. Don’t worry, setting up an account is generally free of charge and only takes a few minutes.

- Select Payment Plan: Once you have logged into the app with your account credentials, you will be able to explore and select from the available payment plans. These plans vary depending on the app, but most offer the option of paying for your purchases in equal installments over a designated period of time. Best of all, if you pay off the balance within the specified timeframe, you won’t be charged any interest!

- Make a Purchase: With your account set up and payment plan selected, you are now ready to start making purchases using the app. Simply browse through the app’s catalog or search for specific items you wish to buy. Once you find something you like, add it to your cart and proceed to the checkout. The app will automatically divide the cost of your purchased items into equal installments based on your chosen payment plan.

- Payment of Installments: After your purchase is complete, it’s important to remember that you will need to repay your balance in installments. Typically, these payments are due on a fortnightly basis. It’s crucial to make your payments on time to avoid any additional charges. If, for any reason, you miss a payment, keep in mind that the app may charge you interest on the outstanding balance.

- Optional Premium Features: Some apps may offer optional premium features that you can choose to add to your account. These features might include higher limits for purchases, increased rewards, or additional benefits. If you’re interested in these premium features and they align with your financial comfort, you can opt in and enjoy the enhanced benefits they provide.

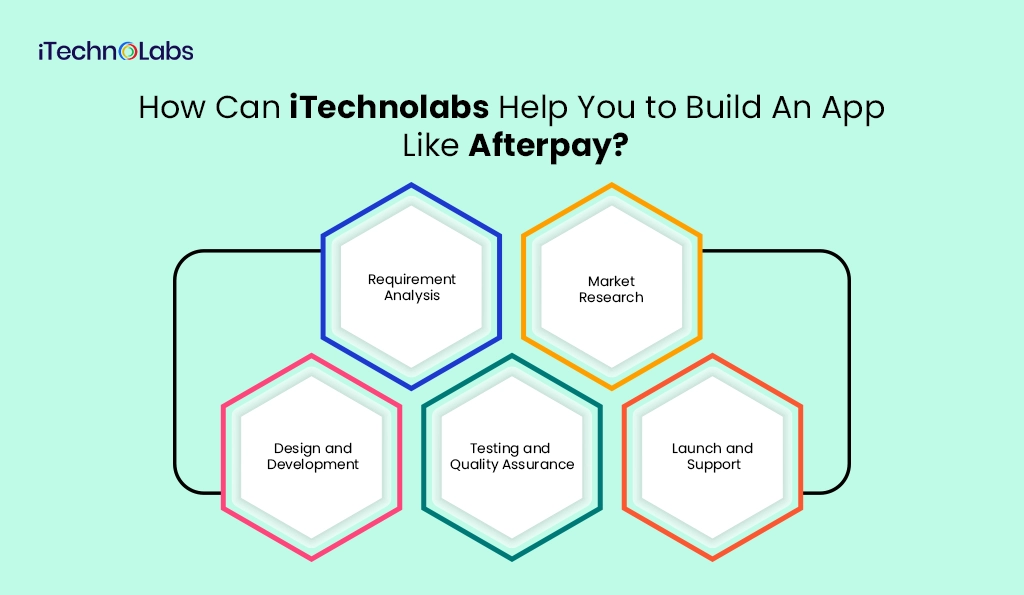

How can iTechnolabs help you to build an app like Afterpay?

iTechnolabs is a leading software development company that specializes in creating custom mobile applications for various industries. Using the latest technologies and innovative approaches, our team can help you build an app like Afterpay that meets your specific requirements and caters to your target audience.

Our development process begins with understanding your business needs and goals. We conduct thorough market research to identify the current trends and competition in the buy now, pay later industry. This helps us to create a unique and user-friendly app that stands out from the crowd.

Our experienced developers work closely with your team to design and develop an app that is tailored to your brand image and meets all your technical specifications. We also provide regular updates and maintain open communication throughout the development process to ensure that your app is delivered on time and within budget.

iTechnolabs follows a comprehensive process to help you build an app like Afterpay.

- Requirement Analysis: The first step involves understanding your specific business needs and goals. We listen carefully to capture all your requirements and expectations for the app.

- Market Research: Our team conducts in-depth market research to identify current trends and understand the competition in the buy now, pay later industry. This is crucial in developing an app that can stand out in the market.

- Design and Development: With the insights and requirements at hand, our experienced developers commence the design and development process. Working closely with your team, we ensure the app aligns with your brand image and meets all your technical specifications.

- Testing and Quality Assurance: Post-development, the app undergoes rigorous testing to ensure it is bug-free and provides a seamless user experience. We adhere to high quality assurance standards, ensuring the app functions optimally.

- Launch and Support: After ensuring everything is in order, we assist with the launch of your app. Thereafter, we provide continuous support and regular updates to keep your app updated with the latest market trends and technologies.

Are you looking for a mobile app development company?

Ensuring security is of utmost importance for apps like Afterpay, developed by iTechnolabs. We go above and beyond to implement robust security measures that safeguard sensitive user data and create a secure environment for transactions. Our dedication to security includes the use of state-of-the-art encryption algorithms and the implementation of two-factor authentication for login procedures, adding an extra layer of protection. To ensure continuous security, we conduct regular security audits to promptly identify and address any potential vulnerabilities in the app. Furthermore, we strictly adhere to all relevant data protection and privacy regulations, further enhancing the security and privacy of the app and providing users with peace of mind.

- Data Encryption: All data transmitted through the app is encrypted using advanced encryption standards. This ensures that the personal and financial information of users is unreadable to anyone who might attempt to intercept the data.

- Authentication: We incorporate strict authentication measures, including two-step verification, to ensure that only the legitimate user can access the account. This adds an extra layer of security and helps in the prevention of unauthorized access.

- Regular Security Updates and Patches: We regularly update the security infrastructure of the app to protect against new threats and vulnerabilities. Security patches are applied promptly to fix any identified issues.

- Security Audits: Regular comprehensive security audits are carried out to detect, prioritize, and fix security risks. These audits help in ensuring the continuous security and integrity of the app.

- Compliance with Regulations: The app is designed to be in compliance with all relevant data protection and privacy laws. This ensures the app meets all legal requirements and protects user data to the highest standard.

Conclusion: Apps Like Afterpay

In conclusion, the apps like Afterpay offer a convenient and secure way to manage your finances. With advanced security measures in place, users can trust that their personal and financial information is safe while using the app. As technology continues to advance, we are committed to continuously enhancing our security protocols to maintain the highest level of protection for our users.

FAQ’s About Apps Like Afterpay

1. What app is better than Afterpay?

Several apps provide similar services like Afterpay, some of which are better than afterpay are Klarna, Quadpay, Sezzle, and Affirm.

2. What is the best pay after app?

Klarna is the best pay after app due to its flexibility and feature of “Pay in 30 days.” Some may prefer Quadpay because it breaks down payment into six installments instead of four installments.

Another one is called Sezzle, which operates pretty much like Afterpay but lets customers split up larger purchases into six interest-free, fee-free installments.

3. Which buy now, pay later app doesn’t check credit?

Afterpay and Sezzle does not use any hard credit check but uses alternative data to approve its installment plan.

4. Is Sezzle like Afterpay?

Sezzle and Afterpay are quite similar in that they offer the same type of service. Afterpay only accepts purchases under $2000 however, there are bigger purchases with Sezzle that may then be split into six interest-and-fee-free installments. Afterpay also requires payments to be four equal payments every two weeks, whereas Sezzle gives more flexibility with the time to pay concerned.

5. How do free streaming sites compare to paid OTT platforms?

Free sites:

-

Cost nothing upfront

-

May have ads

-

Offer varied content quality

Paid OTT services: -

Provide licensed, high-quality content

-

Offer offline downloads and better performance

-

No ads (in many cases)

Free platforms are ideal for casual viewing but may lack premium content.

6. Is it safe to use free streaming sites?

Safety depends on the platform. Reputable, legal streaming sites offer a secure experience. Others may contain:

-

Malware ads

-

Pop-ups

-

Phishing links

Use antivirus software and avoid suspicious sites.

7. How can I build a movie and TV show streaming website?

To build a streaming platform, you need:

-

Content licensing agreements

-

Scalable cloud hosting

-

Video encoding and CDN integration

-

Search and recommendation systems

-

User authentication and profiles

A video streaming platform development company can help plan and launch your site.

8. How much does it cost to develop a streaming platform?

Developing a streaming website/app typically ranges from $40,000 to $250,000+ USD, depending on:

-

Content catalog and licensing

-

Features (search, watchlists, user profiles)

-

Platform support (web, mobile apps)

-

Monetization systems (ads, subscriptions)

A basic MVP may be built on the lower end, while a full-featured OTT platform requires more investment.

9. What technologies power free streaming websites?

Common technologies include:

-

CDN (Content Delivery Network)

-

Adaptive bitrate streaming

-

Cloud storage (AWS, Google Cloud)

-

Frontend frameworks (React, Vue)

-

Backend (Node.js, Python)

These ensure reliable and scalable streaming.

10. Can free streaming sites support multiple languages?

Yes. Many platforms offer:

-

Multi-language content

-

Subtitles or dubbed options

-

Localization features

This enhances accessibility for international audiences.

11. How can I ensure legal and safe streaming?

Choose platforms that:

-

Clearly state licensed content

-

Use secure HTTPS connections

-

Avoid excessive pop-ups

-

Have positive user reviews

Legal streaming ensures safety and supports creators.

12. What is the future of free streaming websites?

In 2026, free streaming sites are expected to:

-

Offer improved HD/4K quality

-

Integrate AI recommendations

-

Support personalized watchlists

-

Expand mobile and smart TV compatibility

User experience will continue to improve.