Fortnite isn’t just a battle royale. It’s a full-on live-service machine that keeps printing money years after that first crazy wave of hype—mostly because Epic never lets the momentum die. Seasons keep rolling, the Item Shop stays dangerously tempting, creators keep getting pushed, and the collaborations keep landing so hard they’ve basically turned Fortnite into a pop-culture billboard (and yes, that’s a compliment). That’s exactly why Fortnite revenue still ranks near the top of gaming searches in 2026.

So what are we doing here? We’re breaking down what Fortnite revenue in 2026 looks like using the newest estimates and the best performance clues available. Then we’ll zoom out to the bigger picture: Fortnite revenue by year from 2018 through 2026, a realistic “how much money does Fortnite make per day” estimate, and the major forces that keep those totals in the multi-billion range—even when the internet insists the game is “dead” every other week.

And we’re not stopping at a headline number. We’ll get into where Fortnite’s money comes from in 2026 by region, including Fortnite revenue by country, and how the revenue split plays out across mobile vs console vs PC. We’ll also look at what Fortnite’s active player count suggests right now, plus spending behavior—because Fortnite’s Item Shop isn’t just a store, it’s a psychology experiment. People don’t buy items because they “need” them—they buy them because they want the vibe, the flex, and the limited-time exclusivity.

We’ll also cover streaming, because Fortnite doesn’t only survive on gameplay—it thrives on attention. The game keeps pulling steady viewer engagement on Twitch, YouTube, and other platforms, and that constant visibility fuels demand for skins, bundles, and event drops.

Finally, we’ll bring it back to what matters for businesses and gaming startups. Fortnite is a case study in repeatable monetization: engagement loops that drag players back in, limited-time drops that destroy self-control, and identity-driven cosmetics that sell status—not power. We’ll also highlight the technical foundation that makes all of this possible. Fortnite’s revenue scale isn’t just smart marketing—it’s what happens when you combine cross-platform development, live ops scalability, and ecosystem-level design. Because fetishization, retention, and cross-platform reach all work together like one system.

Fortnite Revenue in 2026: Latest Earnings Overview

Fortnite’s pulling in serious money in 2026. And it’s pretty clear it’s not just “a popular game” anymore—it’s turned into this always-on digital platform that keeps earning because it never really stops changing.

People toss around estimates of about $6 billion for 2026, which sounds a little wild, but also tracks when you look at how often the game stays in the conversation and how easily it keeps getting players to spend skins, passes, and all that stuff. So yeah, it keeps stacking multi-billion-dollar years.

Most big AAA games cash in hard right after launch, and then the numbers fade. But Fortnite doesn’t work like that—its whole setup is a loop where players keep showing up, and that steady attention turns into purchases week after week, month after month, without needing a “new release” moment.

Epic’s basically built it as a live-service machine, constantly pushing new seasons, big-name crossovers, and creator-made experiences and that constant churn—love it or hate it—keeps the revenue flowing instead of betting everything on one-time box sales.

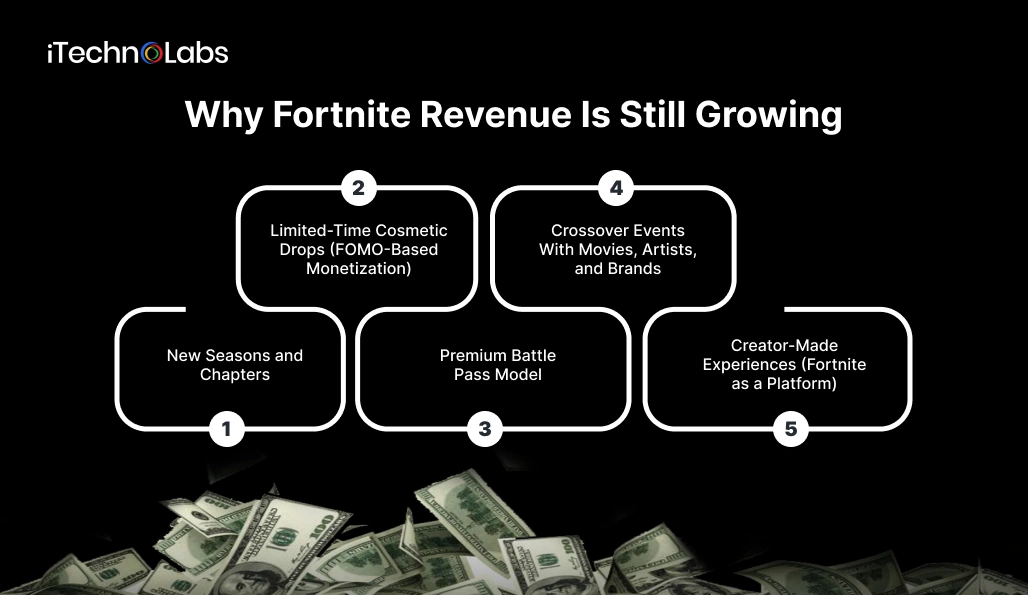

Why Fortnite Revenue in 2026 Is Still Growing

The biggest reason Fortnite still generates huge income is that Epic doesn’t treat Fortnite as a “launch product.” Instead, it is operated like an entertainment service—similar to Netflix, where new “seasons” are released to continuously bring people back.

Fortnite revenue in 2026 is powered by recurring triggers such as:

1) New Seasons and Chapters

Every major season launch acts like a re-release of the game. These updates usually include:

- new storyline progression

- new weapons and gameplay mechanics

- map evolution or full chapter resets

- exclusive battle pass content

This causes major spikes in player activity. When millions of players return at the same time, conversion into purchases rises sharply—especially from players buying battle passes and premium skins.

In other words, Fortnite’s seasonal structure turns content updates into revenue events.

2) Limited-Time Cosmetic Drops (FOMO-Based Monetization)

One of the smartest Fortnite monetization tactics is its use of scarcity.

The item shop is designed around:

- rotating daily cosmetics

- time-limited bundles

- rare skin re-releases

- exclusive crossover skins

This creates “fear of missing out” (FOMO), which strongly increases impulsive purchases.

This is why Fortnite generates consistent revenue even when players don’t buy every season. Many users spend selectively, but in high volume, especially during rare drops.

3) Premium Battle Pass Model

The Battle Pass is the most stable revenue engine for Fortnite.

It works so well because:

- the price-to-value ratio is high

- it encourages daily play

- it offers exclusive skins/items tied to progression

- it builds habit and increases retention

Most importantly, the Battle Pass doesn’t feel like a “purchase.” It feels like an investment in progression and identity, which is why it drives both engagement and monetization at the same time

4) Crossover Events With Movies, Artists, and Brands

Fortnite is also one of the most powerful brand-collaboration platforms in gaming.

Epic regularly partners with:

- major movie franchises

- music artists

- anime and pop culture brands

- sports personalities

These collaborations generate revenue because they:

- attract non-gamers and casual players

- bring back dormant users

- trigger high-spending behavior due to exclusivity

- create viral attention through social media and streaming

This strategy expands Fortnite beyond gaming and positions it as a global digital entertainment space, increasing both reach and sales potential.

5) Creator-Made Experiences (Fortnite as a Platform)

A major reason Fortnite revenue in 2026 remains stable is that Fortnite no longer depends entirely on Epic’s internal content.

Fortnite Creative and UGC experiences allow:

- creators to build maps and game modes

- players to explore new content daily

- the platform to scale content output without scaling internal development costs

This is important because more content equals:

- more time spent in-game

- more returning users

- more shop exposure

- more purchases

It’s the same model seen in platforms like YouTube or Roblox—where creator ecosystems drive long-term growth.

Also Read : Android Vs iOS Development: Key Differences, Features And Insights

Fortnite Revenue By Year: 2018 to 2026

When people search “Fortnite revenue by year”, they’re usually trying to understand one key thing:

Is Fortnite still making money at the same scale as its peak years?

According to revenue analysis, Fortnite generated more than $42.2 billion in total revenue between 2018 and 2026, with annual revenue estimates ranging from $3.7 billion to $6.2 billion, depending on the year.

While the exact year-by-year numbers may vary by reporting source, the overall message remains consistent: Fortnite has sustained multi-billion-dollar annual earnings for years, making it one of the most profitable free-to-play games in modern history.

This is exactly why Fortnite remains a benchmark when discussing:

- live-service monetization models

- in-game purchase revenue strategies

- long-term engagement-based growth

Why Fortnite Revenue Stayed High Across Multiple Years?

The most important takeaway from the 2018 to 2026 Fortnite revenue timeline is that Fortnite’s growth wasn’t based on luck or a one-time trend. It was engineered through repeatable systems that continually bring players back—and convert engagement into purchases.

Here’s what drives Fortnite’s consistent revenue performance year after year:

1) Constant In-Game Content Updates

Fortnite is structured so that the game never feels finished. Epic releases:

- frequent gameplay updates

- new mechanics and loot rotations

- limited-time modes

- map changes and visual refreshes

These updates do more than keep players entertained—they increase session frequency, meaning players log in more often, see the Item Shop more frequently, and are more likely to spend.

That’s why Fortnite earnings don’t rely on game sales. Instead, Fortnite earns through continuous usage.

2) Seasonal Engagement Loops That Reset Demand

Fortnite has perfected the “season model,” where each season acts like a fresh marketing cycle. Every new season typically introduces:

- a new battle pass

- exclusive skins and unlockables

- storyline progression

- a refreshed content roadmap

This system creates predictable spikes in:

- player reactivation

- battle pass purchases

- V-Bucks purchases

- cosmetic demand

This is a major reason why Fortnite revenue per year remains stable. Each season resets motivation, increases engagement, and renews spending behavior.

3) Creator-Driven Retention (UGC + Creative Experiences)

A major reason Fortnite didn’t burn out after its peak years is that it evolved from a single game into a platform.

Fortnite Creative enabled:

- user-generated game modes

- creator-built maps

- community-driven content diversity

This strategy increases:

- daily active users

- time spent on the platform

- repeat sessions

- exposure to monetized content

As a result, Fortnite’s revenue base expanded beyond one audience. The game became a living ecosystem.

4) Cross-Media Brand Marketing (Collaborations That Drive Revenue Spikes)

One of the biggest drivers behind Fortnite’s sustained yearly revenue is its collaboration engine.

Fortnite continuously partners with:

- blockbuster movie franchises

- music artists

- anime and pop culture IPs

- sports and celebrity brands

These collaborations create high-intent purchase windows because:

- skins are time-limited

- items feel collectible

- demand is boosted by social media and influencers

- returning players rejoin just to buy crossover bundles

This is why Fortnite’s yearly revenue can spike heavily during major crossover launches.

Fortnite Revenue by Year Trend: What It Really Shows

Even if the year-by-year values shift slightly depending on who reports them, Fortnite’s annual timeline still proves something rare:

Most games have:

- a “launch year peak”

- followed by a sharp decline

Fortnite instead has:

- multiple peaks

- recurring revenue cycles

- year-to-year stability

That’s why the Fortnite revenue model is studied by game developers, startups, and digital platforms—it shows how to create earnings through repeatable engagement.

How Much Money Does Fortnite Make Per Day? (With Amounts)

One of the most searched questions related to Fortnite revenue is: How much money does Fortnite make per day?

Epic Games does not publish Fortnite’s daily revenue publicly, so the numbers available online are mostly based on third-party estimates. However, these e stimates still help explain the scale at which Fortnite earns and why it remains one of the highest-earning live-service games in the world.

1. Estimated Daily Revenue Range (Realistic View)

Because Fortnite runs on seasonal updates and limited-time events, it does not earn the same amount every day.

Based on monthly revenue estimates shared by third-party trackers, Fortnite’s earning potential can range around:

- $0.4M to $2.0M per day in quieter periods

- $2.0M to $6.0M+ per day during stronger seasonal demand and high activity cycles

For example, ActivePlayer shows monthly revenue ranges such as $13.6M to $51.1M over the last 30 days, which roughly converts to about $0.45M to $1.7M per day when averaged out.

This helps illustrate one key point: Fortnite earns massive daily revenue even without selling the game itself.

2. When Fortnite Daily Revenue Spikes the Most

Fortnite’s daily earnings jump sharply during key content windows, especially:

- New season launches (Battle Pass purchases and item shop demand rise immediately)

- Major collaboration drops (limited-time skins and bundles sell quickly)

- Event weekends (live concerts, storyline events, competitive cycles)

- Holiday periods (higher player activity and gift-based spending)

A good example of content-driven spikes is mobile earnings early in Fortnite’s lifecycle. Sensor Tower reported that Fortnite’s iOS version was estimated at $1.2M/day during one early stretch, rising to about $2M/day during the launch window of Season 5 (mobile only, not total revenue).

Also Read : AI-Powered Mobile App Development Trends 2026

Fortnite Annual Revenue Breakdown: Yearly Highlights

Below is Fortnite’s estimated revenue performance year over year, starting from its breakout year in 2018 through projected 2026 figures.

| Year | Estimated Fortnite Revenue |

| 2018 | $5.5 billion |

| 2019 | $3.7 billion |

| 2020 | $5.1 billion |

| 2021 | $4.2 billion |

| 2022 | $5.8 billion |

| 2023 | $6.2 billion |

| 2024 | $5.7 billion |

| 2026 (Projected) | $6.0 billion |

| Total Revenue (2018–2026) | ~$42.2 billion |

Why Daily Revenue Isn’t Stable

Fortnite monetization works like an entertainment platform. Player spending increases when:

- new premium cosmetics are released

- the shop rotates rare skins

- the Battle Pass refreshes

- creators and streamers generate hype

- limited-time content creates urgency

So instead of earning a fixed daily amount, Fortnite moves in waves—with “high-spend” weeks driven by content releases.

Fortnite Revenue by Country: Top-Grossing Regions in 2026

When analyzing Fortnite revenue by country, one fact stands out clearly: the United States leads Fortnite spending by a wide margin. In most market breakdowns, the U.S. is estimated to contribute close to 40% of global Fortnite revenue, largely because of its console-first player base, strong Battle Pass adoption, and higher average spend per user.

However, Fortnite isn’t dependent on just one region. Several countries consistently rank among the top contributors because of high player engagement, platform dominance (console/PC/mobile), and strong seasonal buying behavior.

Below is a snapshot of the top revenue-contributing countries and what drives Fortnite purchases in each market.

Top Countries Driving Fortnite Revenue (2026 Snapshot)

| Country | Platform Dominance | Global Revenue Share | Spending Traits |

| United States | Console & PC | ~40% | High-value bundles, Battle Pass, event skins |

| Brazil | Mobile & Console | ~12% | Mobile-first engagement, strong seasonal spending |

| Russia | PC & Android | ~7% | Large player base, lower per-user spend but high activity |

| United Kingdom | Console | ~6% | Strong Battle Pass uptake, event-driven item shop purchases |

| Germany | Console & PC | ~5% | Consistent seasonal spending, steady cosmetic purchases |

USA, Brazil, Russia: The Strongest Regional Fortnite Revenue Leaders

The United States remains Fortnite’s largest financial engine, but Brazil and Russia are also major revenue contributors, largely because of their large active user bases and strong engagement cycles across different platforms.

What makes these regions important is not just the number of players — but how players spend based on device usage and purchasing habits.

How Platform Preferences Shape Fortnite Spending?

Each country’s preferred platform plays a major role in how Fortnite monetizes that audience:

United States (Console-Led Spending)

The U.S. market is heavily driven by console purchases, especially during:

- new Battle Pass launches

- crossover bundles (movies, anime, music drops)

- time-limited events

Players here are more likely to buy premium items, resulting in higher average transaction values.

Brazil (Mobile-Heavy, High Engagement)

Brazil is one of Fortnite’s most active engagement markets, supported by:

- strong mobile adoption

- high daily playtime patterns

- fast response to seasonal events and cosmetics

Even when purchases are smaller than the U.S. on average, Brazil’s high engagement volume keeps it among the top countries for revenue contribution.

Russia (Large Base, Lower Spend Per User)

Russia contributes strongly due to:

- a massive install/player base

- PC and Android dominance

- high activity during major updates

Spending behavior tends to be more value-focused, meaning lower average spend per player, but the confirmed engagement scale makes it a consistent contributor.

Why Fortnite’s Global Revenue Spread Matters?

This global distribution explains why Fortnite continues to generate multi-billion-dollar annual revenue and why Epic Games focuses heavily on:

- regional time-zone friendly events

- culturally relevant collaborations

- localized shop rotations

- seasonal content schedules

In short, Fortnite monetizes not just through a single “top market,” but through a smart balance of:

- premium spenders (U.S., UK, Germany)

- high-volume engagement markets (Brazil, Russia)

That’s a major reason Fortnite has maintained its massive lifetime revenue scale and continues to thrive in 2026.

Also Read : How to use AI in Sales and Marketing?

Which Devices Generate the Most Revenue? Mobile vs Console vs PC?

A major topic is: Which platform generates the most Fortnite revenue—mobile, console, or PC?

In most monetization models, console leads revenue share, driven by:

- longer session length

- smoother payment experience

- higher cosmetic purchase rate

- strong battle pass adoption

PC revenue share stays strong due to competitive and creator audiences, while mobile performance varies based on access and platform policies.

Epic has also expanded its ecosystem significantly, reporting 898 million total Epic cross-platform accounts in its 2024 Year in Review.

Fortnite Revenue by Platform (Estimated Split)

| Platform | Approx. Revenue Contribution | Key Characteristics |

| Console | ~60% | Highest average spend per player, strong Battle Pass and bundle purchases |

| PC | ~25% | Consistent playtime and competitive audience, comparatively lower spending rate |

| Mobile | ~15% (pre-2021) | Large user volume, micro-transaction heavy purchasing behavior |

Where Does Fortnite Make Its Money?

So where exactly does Fortnite’s multi-billion-dollar revenue come from?

Even though Fortnite is free-to-play, it has become a monetization masterclass. Epic Games blends in-game psychology, cultural trends, and timed scarcity to encourage spending—without introducing pay-to-win mechanics.

Fortnite earns money because it sells what players care about most in social gaming environments:

identity, exclusivity, and visibility.

Below is a clear breakdown of Fortnite’s main income streams.

In-Game Purchases (Skins, Emotes, Bundles)

This is the biggest driver of Fortnite revenue.

Most of Fortnite’s earnings flow through cosmetics, including:

- skins

- emotes

- pickaxes

- weapon wraps

- gliders

- limited-time bundles

- collaboration packs

Popular branded crossovers (Marvel, Star Wars, anime drops, and celebrity collaborations) create huge spikes because players want exclusive cosmetics that feel rare and collectible.

The best part of Fortnite’s strategy is that players aren’t paying to win — they’re paying to be seen. In Fortnite, style is social currency.

Battle Pass (Seasonal Monetization Model)

Every new season introduces a refreshed Battle Pass, which is typically priced around $7.99 (varies slightly by region). It is designed to do two things at once:

- Drive consistent play through progression rewards

- Increase seasonal spending through premium unlockables

This model is powerful because the Battle Pass feels like:

- high value

- limited-time

- tied to season identity

It also acts as a gateway to further spending: once players are engaged daily, they’re more likely to buy additional cosmetics from the Item Shop.

Fortnite Crew Subscription

Fortnite Crew, launched in December 2020, adds predictable recurring income through a subscription model.

The monthly subscription typically includes:

- exclusive skins

- 1,000 V-Bucks

- Battle Pass access

- additional benefits/perks

At around $11.99/month, Fortnite Crew has created a dedicated subscriber base, making it a stable, passive revenue stream even outside major seasonal spikes.

Fortnite Revenue Breakdown by Source (Estimated)

Here’s a simplified view of how Fortnite’s income is distributed across monetization streams (based on available estimates):

| Revenue Source | Contribution (%) | Key Drivers |

| V-Bucks (Cosmetics) | 58% | Skins, emotes, wraps, bundles |

| Battle Pass | 22% | Season-based rewards and progression |

| Fortnite Crew | 10% | Monthly skins, V-Bucks, perks |

| Event Bundles | 7% | Collaborations, limited-time offers |

| Other (Licensing, etc.) | 3% | Merch, licensing, partnerships |

What’s fascinating is that none of these revenue sources change gameplay balance. Fortnite monetizes through aesthetics and identity, not advantage.

Fortnite Sales: How Many Copies Has Fortnite Sold?

Here’s where things get interesting.

Fortnite hasn’t “sold copies” in the traditional way. Since it’s free-to-play, anyone can download and play without paying upfront.

So when people ask:

“How many copies has Fortnite sold?”

The answer is:

Zero copies — but hundreds of millions of players.

Instead of sales, Fortnite’s success is measured through:

- Registered Players: 650M+ globally (as of 2025 estimates)

- Monthly Active Users (MAU): 200M+ range in strong cycles

- Peak Concurrent Players: 30M+ during major events

This is exactly why Fortnite is such a dominant business model:

it earns more than most paid games ever will, purely through optional spending.

Fortnite Player Count 2026: How Many People Play Fortnite Today?

Fortnite continues to rank among the most played online games worldwide, even in 2026. However, Epic Games does not consistently publish real-time player counts, so most public player data is presented through a mix of:

- Epic ecosystem reporting (Year in Review)

- event-based peak announcements

- third-party tracker estimates

The key takeaway is simple: Fortnite player activity is seasonal. Player counts rise sharply during new seasons, chapters, collaborations, and live events, then stabilize until the next major content refresh.

| Player Metric | What It Measures | What It Looks Like in 2026 | Why It Matters for Fortnite’s Growth |

| Registered Players (Lifetime Accounts) | Total accounts created since launch | Hundreds of millions globally | Shows Fortnite’s long-term global reach and brand scale |

| Monthly Active Users (MAU) | Unique players active per month | Strong and consistent; rises sharply during new seasons | Indicates retention strength and monthly platform stickiness |

| Daily Active Users (DAU) | Unique players active per day | Highly seasonal; higher during updates/events | Measures daily engagement and repeat usage behavior |

| Peak Concurrent Players (CCU) | Players online at the same time | Major spikes during live events and major launches | Highlights Fortnite’s ability to pull massive live audiences |

| Season & Chapter Launch Uplift | Player return rate during major updates | Significant engagement surge every launch cycle | Proves Fortnite’s content-driven growth engine |

| Creator / UGC Engagement | Players active in Creative experiences | Growing share of total activity | Extends gameplay variety and reduces player churn |

| Event-Driven Peaks | Spikes from concerts/collabs/story events | Highest activity windows of the year | Drives reactivation + boosts cosmetic and bundle sales |

Fortnite Player Spending Stats: How Much Do People Spend on Fortnite?

Fortnite players mainly spend money for style, identity, and social visibility—not for gameplay advantage. Since Fortnite is not pay-to-win, spending stays strong year after year through cosmetics and limited-time drops.

Estimated spending amounts (based on published surveys/industry estimates):

- Average spend per paying player: around $102 per year on cosmetics and items

- Average revenue per user (ARPU): roughly $20–$30 globally (includes non-spenders)

What players spend on most?

- Battle Pass (seasonal purchase)

- Premium skins

- Crossover bundles

- Limited-time Item Shop drops

- Emotes and accessories

This is why Fortnite’s monetization works long-term: players spend voluntarily on cosmetics and exclusivity—without affecting competitive balance.

Also Read : Web3 iOS App Development Roadmap

What Are the Gender Demographics of Fortnite Players?

Fortnite still gets labeled a guy’s game. But that gap? It’s shrinking, slowly, year by year.

And you can kind of see why: the game keeps changing, it’s easy to hop in with friends and just mess around, and the big collabs pull in people who wouldn’t have cared otherwise (so why wouldn’t more women show up too?). Not overnight. Not perfectly. Still, it’s nudging toward a bigger crowd than it used to have.

| Gender | Percentage of Players |

| Male | 72% |

| Female | 28% |

Fortnite vs Competitors: Is Fortnite Bigger Than GTA 5?

The question “Fortnite vs GTA 5” is common—but the answer depends on what you mean by bigger. Both games are massive global successes, but they dominate in different areas because their revenue models are fundamentally different.

Fortnite is built as a live-service platform, designed to generate recurring digital revenue through seasons, cosmetics, and collaborations. GTA 5, on the other hand, is a premium blockbuster franchise, known for long-term sales, cultural impact, and the strength of its RP ecosystem.

Fortnite vs GTA 5 Comparison Table

| Category | Fortnite | GTA 5 |

| Business Model | Free-to-play live service | Premium game + online ecosystem |

| Main Revenue Driver | Cosmetics, V-Bucks, Battle Pass, subscriptions | Game sales legacy + GTA Online monetization |

| Content Strategy | Seasonal reactivation + frequent updates | Long-term online evolution + RP expansion |

| Monetization Strength | High recurring spending through identity items | Strong franchise-driven monetization over time |

| Brand Partnerships | Major advantage (Marvel, Star Wars, music, anime) | Limited compared to Fortnite |

| Accessibility | Highly accessible globally due to free-to-play | Requires purchase entry for full experience |

| Community Ecosystem | Battle Royale + Creative/UGC growth | Roleplay (RP) + open-world replayability |

| Best Known For | Live events, collaborations, and monetization innovation | Cultural legacy, RP dominance, and premium franchise power |

Key takeaway: Fortnite is engineered to generate recurring digital revenue like an evolving platform, while GTA 5 succeeds through premium franchise value and long-term engagement ecosystems (especially GTA Online and RP).

What Can Businesses Learn From Fortnite’s Revenue Strategy?

Fortnite shows how online money works now: it’s about getting people to come back, not getting them to pay once and disappear. And Epic doesn’t bank on a big upfront sale— they keep the loop going with new seasons, timed events, and stuff the community actually cares about, then they cash in on that steady attention with optional add-ons (skins and whatever else catches your eye).

Key Business Lessons From Fortnite

- Monetize identity, not power: Players spend to express themselves (skins, emotes), not to gain unfair advantages.

- Run seasonal content like entertainment releases: Each season feels like a new “episode,” reactivating users and boosting spending.

- Create urgency with limited drops: Rotating shops and time-limited bundles increase conversion through scarcity.

- Let creators scale your platform: User-generated content increases retention without increasing internal production costs.

- Keep purchases optional to maintain trust: Non-pay-to-win monetization protects competitive fairness and long-term loyalty.

This strategy isn’t limited to gaming. The same playbook works for subscription apps, marketplaces, creator platforms, and consumer products that depend on long-term engagement and recurring revenue.

How iTechnolabs Helps Game Creators Scale Like Fortnite?

Fortnite didn’t blow up just because it feels good to play. Not even close. And if you want a game to actually make money now, you need the stuff around the gameplay—the kind of live-service setup that can scale without breaking, retention loops that keep people coming back (even when they swear they’re “done”), and monetization that doesn’t stall out the minute your audience grows.

At iTechnolabs, we work with studios and publishers who want to build games that last. So we help teams design and build products shaped by live-service hits like Fortnite, covering the messy middle from early MVPs all the way through launch, updates, and growth—because a “release it and hope” plan isn’t really a plan (you already know that).

How Much Money Has Fortnite Made from In-App Purchases?

Since launching in 2017, Fortnite has generated an estimated $40B+ in lifetime revenue, with the largest portion coming from in-app purchases (IAP). That includes spending on V-Bucks, skins, Battle Passes, Fortnite Crew subscriptions, and limited-time event bundles.

Because Fortnite is free-to-play, Epic’s model relies on scale: even if a large percentage of users never spend, a smaller group of paying players can still drive billions in yearly earnings.

How Much Do Fortnite Players Spend?

Here’s a simplified breakdown of estimated Fortnite spending behavior across the player base:

| Spending Bracket | % of Players (Approx.) | What They Usually Buy |

| $0 (Free Players) | 38% | Play casually without purchases |

| $1 – $50 | 34% | Battle Pass, occasional skins |

| $51 – $200 | 20% | Seasonal spending, bundles, more cosmetics |

| $200+ | 8% | Dedicated players, collectors, frequent item-shop buyers |

Key Spending Insights (Estimates)

- Average spending per paying user: ~$84

- Average revenue per user (ARPU): $20–$30 globally (includes non-spenders)

- Top-spending event day example: $5.2M in 24 hours (Travis Scott event estimate)

Bottom line: Fortnite doesn’t need every player to pay. When even a small share spends consistently—at global scale—it becomes a massive revenue engine powered almost entirely by optional in-app purchases.

What iTechnolabs Can Build for Your Game?

Our team helps you design and implement the systems required to scale efficiently, including:

- Unity and Unreal game development for high-performance mobile and console experiences

- Multiplayer backend engineering for matchmaking, real-time gameplay, and scalable servers

- Live ops infrastructure to support seasonal updates, events, and continuous content drops

- In-game store and economy design to power secure purchases, pricing models, and digital currencies

- Battle Pass systems and seasonal progression for recurring engagement and predictable monetization

- Creator tools and UGC enablement to expand content output through player-driven creativity

- Analytics and retention optimization to track user behavior, boost engagement, and reduce churn

- Cloud scalability and performance engineering to handle growth spikes, global traffic, and peak concurrent usage

Whether you’re building a battle royale, a social multiplayer game, or a creator-led ecosystem, iTechnolabs helps you develop both the technology stack and monetization strategy needed to scale like the world’s top live-service games.

Conclusion

Fortnite didn’t just get big—it turned into a nonstop money machine by mixing clever monetization with seasons people actually stick around for, then piling on updates at a pace most studios can’t keep up with. And yeah, the takeaway’s pretty blunt: if your systems don’t scale and your design doesn’t obsess over keeping players coming back, the “fun gameplay” part won’t save you for long.

At iTechnolabs, we help teams take a wild idea and make it real—then make it hold up under pressure, even when player counts spike, content drops get hectic, and the business side needs to run without duct tape. So we build the guts: multiplayer backends, live-ops tooling and pipelines, monetization setups, and creator-friendly ecosystems that don’t collapse the moment things get interesting (because they will).

So what are you trying to ship—a small experiment, or something that can actually grow into a live-service beast? And if want a modern game that can scale in the same universe as Fortnite, iTechnolabs can help you launch it, grow it, and bring in revenue without guessing the whole way.

Frequently Asked Questions

How much profit does Fortnite make?

Fortnite’s exact profit isn’t publicly disclosed because Epic Games doesn’t report Fortnite-specific profit margins. However, Fortnite is widely considered one of the most profitable live-service games ever due to its low-cost digital products (skins, emotes, Battle Pass) and massive player scale. Since most revenue comes from in-game purchases with minimal per-unit delivery cost, a large share of Fortnite’s earnings is believed to convert into operating profit after platform fees and development costs.

Why did Fortnite have to pay $500 million?

Fortnite’s publisher Epic Games agreed to pay $520 million to settle Federal Trade Commission (FTC) allegations. The settlement included:

- $275 million penalty related to alleged privacy violations involving children, and

- $245 million in consumer refunds tied to “dark patterns” and billing practices.

This case became one of the biggest regulatory actions in gaming history and pushed the industry toward more transparent purchase and privacy systems.

Is Fortnite bigger than GTA 5?

It depends on how you define “bigger.”

Fortnite is bigger in:

- live-service monetization and recurring revenue

- seasonal engagement and reactivation cycles

- global free-to-play accessibility

- pop culture collaborations and events

GTA 5 is bigger in:

- premium sales legacy and long-term franchise value

- roleplay (RP) longevity and community-driven replay value

- cultural impact as a premium blockbuster

In short, Fortnite operates like a constantly evolving platform, while GTA 5 dominates as a premium franchise with long-term ecosystem strength.

How much did Fortnite make in 2025?

Epic Games does not release official Fortnite yearly revenue figures publicly, but multiple industry estimates suggest Fortnite remained a multi-billion-dollar title in 2025. Based on trend-based reporting, Fortnite revenue in 2025 is often projected in the $5B–$6B range, depending on seasons, collaborations, and player spending cycles.