Technology has revolutionized the financial industry, leading to the rise of FinTech companies as major players in this evolving landscape. These companies leverage cutting-edge technologies to offer innovative financial services and solutions that were previously unimaginable. With the abundance of data available in today’s digital age, FinTech companies must develop a solid business intelligence (BI) strategy. This strategy enables them to analyze vast amounts of data, gain valuable insights, and make informed decisions. By doing so, they can stay competitive and thrive in today’s fast-paced market, continuously adapting to changing trends and customer needs. Effective BI strategies are key to unlocking the full potential of data, driving growth, and ensuring long-term success in the highly competitive FinTech sector.

What is BI Strategy?

Business intelligence (BI) strategy refers to a set of processes, tools, and technologies that enable companies to collect, analyze, and interpret data to make strategic business decisions. It involves identifying key data sources, extracting relevant information from them, and using this information to gain insights into the company’s performance and market trends. A well-developed BI strategy allows companies to turn raw data into actionable insights that drive growth and profitability.

BI strategies are essential for any company operating in today’s digital landscape. However, they are particularly crucial for FinTech companies due to their heavy reliance on technology and data-driven decision-making. These companies deal with vast amounts of financial data, including customer transactions, market trends, and regulatory requirements. A solid BI strategy helps them manage this data effectively, identify patterns and trends, and make informed decisions that drive business growth.

Also Read: The Utilization of APIs in Fintech and Banking Industry

Benefits of Business Intelligence in Financial Services

A robust BI strategy can bring numerous benefits to financial services companies, including:

1. Data-Driven Decision Making:

BI tools allow companies to access, analyze, and visualize vast amounts of data in real-time. This enables them to make informed decisions based on accurate and up-to-date information instead of relying on gut feeling or intuition. By leveraging these tools, businesses can identify trends, uncover insights, and optimize operations with greater precision. Furthermore, the ability to create detailed reports and interactive dashboards empowers teams to collaborate more effectively and align their strategies with data-driven evidence.

2. Customer Behavior Analysis:

FinTech companies rely heavily on customer data to understand their needs, and preferences, and provide personalized services. By leveraging Business Intelligence (BI) tools, these companies can perform a comprehensive analysis of customer behavior by tracking various data points such as online interactions, transaction history, and feedback. This allows FinTech companies to gain deeper insights into their customers’ habits and preferences. With these insights, they can better tailor their offerings to meet specific customer needs, identify opportunities for cross-selling or upselling, and ultimately enhance overall customer satisfaction. Additionally, the use of advanced analytics can help FinTech companies predict future trends, personalize marketing strategies, and develop innovative financial products that align with the evolving demands of their customer base. Thus, the integration of BI tools is crucial for FinTech companies aiming to stay competitive and foster strong customer relationships in a rapidly changing market.

3. Risk Management and Fraud Detection:

One of the main concerns for FinTech companies is managing and mitigating potential risks associated with financial services. This includes protecting their customers’ data, preventing fraudulent activities, and ensuring regulatory compliance. BI tools enable FinTech companies to access and analyze vast amounts of data in real time, identify anomalies or suspicious patterns, and take immediate action to mitigate any threats. By leveraging predictive analytics and machine learning algorithms, these tools can also help detect fraud and prevent financial losses. Moreover, by centralizing all data sources onto a single platform, FinTech companies can gain a 360-degree view of their operations and quickly identify any potential areas of vulnerability, enabling them to proactively address any risk factors before they escalate.

4. Product and Service Innovation:

As the FinTech industry continues to grow and evolve, the pressure to innovate and stay ahead of competitors is higher than ever. BI tools can play a crucial role in this regard by providing valuable insights into customer behavior and needs, market trends, and competitive analysis, all of which are essential for developing new financial products and services that meet evolving demands. By using BI tools to analyze customer data and feedback, FinTech companies can identify pain points or areas for improvement in their existing offerings and use those insights to develop innovative solutions that set them apart from their competitors.

5. Operational Optimization:

FinTech companies heavily rely on technology to deliver their services, making operational efficiency critical for success. BI tools help streamline operations by automating manual processes and providing real-time visibility into key performance indicators (KPIs). This enables FinTech companies to identify bottlenecks or inefficiencies in their processes and make data-driven decisions to optimize operations and reduce costs. Additionally, BI tools can also assist with compliance management, regulatory reporting, and risk assessment, making it easier for FinTech companies to meet industry standards and regulations.

6. Competitive Intelligence:

With the rapid growth of the FinTech industry, competition is fierce. BI tools can help companies gain a competitive edge by providing actionable insights into market trends, customer behavior, and competitor strategies. By monitoring their competitors’ performance and analyzing market data, FinTech companies can adapt quickly to changes in the industry and stay ahead of their competitors.

7. Regulatory Compliance:

The financial industry is heavily regulated, and FinTech companies are no exception. Navigating the complex web of regulations can be daunting, but Business Intelligence (BI) tools can help streamline compliance management by providing automated reports and analytics that ensure regulatory requirements are met. These tools can track and analyze vast amounts of data in real time, offering insights that manual processes simply can’t match. This not only saves time and resources but also reduces the risk of non-compliance penalties, which can be costly and damaging to a company’s reputation. By leveraging BI tools, FinTech companies can focus more on innovation and growth while maintaining stringent compliance standards.

8. Marketing and Sales Optimization:

BI tools can also improve marketing and sales efforts by providing data-driven insights to optimize campaigns, increase customer acquisition, and improve customer retention. With the ability to analyze large volumes of data, these tools can identify patterns and trends in customer behavior, preferences, and buying habits. This information can be used to tailor marketing strategies for better targeting and higher conversion rates. Additionally, BI tools can track the performance of various sales channels, enabling companies to make informed decisions about resource allocation and maximize ROI.

9. Financial Planning and Forecasting:

FinTech companies operate in a fast-paced and highly competitive environment, making accurate financial planning and forecasting crucial for success. BI tools can help with this by providing real-time visibility into financial data, allowing companies to make informed decisions based on up-to-date information. These tools can also simulate different scenarios and predict outcomes, enabling companies to anticipate potential risks and plan accordingly. By leveraging advanced analytics and predictive modeling capabilities, FinTech companies can make more accurate forecasts and better manage their finances.

10. Scalability and Agility:

In today’s digital landscape, scalability and agility are key to survival. As FinTech companies grow and expand their operations, they need tools that can keep up with their evolving needs. BI tools offer the flexibility and scalability necessary for businesses to adapt quickly to changing market conditions, customer demands, and regulatory requirements. These tools also provide a centralized platform for data management, making it easier to scale operations without sacrificing performance or data accuracy.

11. Collaborative Decision Making:

Collaboration and teamwork are essential for success in the FinTech industry. BI tools facilitate collaborative decision-making by providing a single source of truth for all stakeholders. With real-time data accessibility, teams can work together to analyze information and make data-driven decisions that align with business goals. This promotes transparency, accountability, and alignment across departments, leading to more effective decision-making.

12. Data Governance and Security:

As FinTech companies deal with sensitive financial data, ensuring the security and integrity of their data is crucial. BI tools offer robust data governance features that help organizations maintain compliance with regulatory standards and protect against cyber threats. These tools also provide secure access controls, audit trails, and encryption capabilities to keep sensitive information safe from unauthorized access.

Key Features of Business Intelligence in the Fintech Industry

Some of the key features that make BI tools well-suited for the FinTech industry include:

1. Advanced Analytics

BI tools offer advanced analytics capabilities that help businesses uncover hidden insights and trends in their data. These include predictive analytics, data mining, and machine learning algorithms that can identify patterns and make accurate predictions for future market trends.

2. Real-time Data Processing

FinTech companies require real-time access to data for quick decision-making. BI tools can process large volumes of data in real time, providing up-to-date insights that help businesses stay ahead of the competition.

3. Data Integration

BI tools can integrate data from various sources, including internal systems and external databases, to create a unified view of the organization’s data. This eliminates data silos and enables businesses to get a holistic view of their operations.

4. Secure Architecture

BI tools offer robust security features to ensure data privacy and compliance with regulatory standards. This includes user authentication, access controls, and encryption capabilities to protect sensitive information from cyber threats.

5. Scalability

As FinTech businesses grow, they need tools that can scale with their operations. BI tools offer scalability by allowing businesses to add new data sources and increase processing power as needed without sacrificing performance.

6. High Overall Performance

BI tools are designed to handle large volumes of data and deliver fast processing speeds. This allows FinTech companies to analyze large datasets on time, enabling them to make informed business decisions.

7. User-friendly Visualization

BI tools present data in visually appealing and interactive formats, making it easier for FinTech professionals to understand complex data. This enables them to quickly identify trends, patterns, and insights that can help improve business strategies.

8. Mobile and Cloud Compatibility

In today’s digital age, FinTech companies need tools that can be accessed from anywhere at any time. BI tools offer mobile and cloud compatibility, allowing users to access data and insights on the go and collaborate with team members in real time.

9. Self-provider Talents

BI tools offer self-service capabilities that enable FinTech professionals to generate their reports and dashboards without relying on IT or data analysts. This reduces the burden on IT teams and empowers business users to make faster, data-driven decisions.

10. Collaboration and sharing

BI tools allow for easy collaboration and sharing of data and insights across teams within a FinTech organization. This promotes transparency, efficiency, and alignment among different departments, leading to better business outcomes.

Read More: Best Financial Companies Using Flutter Technology

How to Build a BI Strategy For Your Fintech Business?

Building a solid BI strategy is crucial for the success of any FinTech business. Here are some key steps to consider when developing a BI strategy for your company:

1. Establish Your Business Dreams:

The first step towards building a BI strategy is to clearly define your business goals and objectives. This will help you identify the specific metrics and key performance indicators (KPIs) that are critical to measuring success.

2. Evaluate The Kingdom Of Your Records:

Next, assess the data available within your organization. This includes both internal and external sources, such as customer data, financial records, market data, and more. Internal sources might encompass sales reports, employee performance metrics, and inventory logs, while external sources could include industry benchmarks, competitor analysis, and demographic information. This comprehensive evaluation will give you an idea of what types of insights can be derived from your data and will help you identify gaps that may need to be filled to make more informed decisions.

3. Establish A Statistics Governance Framework:

To ensure the accuracy and reliability of your data, it is essential to establish a comprehensive governance framework. This includes creating detailed policies and procedures for data collection, storage, and usage, such as specifying the tools and methods to be used and setting guidelines for data access and security. Additionally, it involves defining clear roles and responsibilities for maintaining data quality, designating data stewards, and implementing regular audits and reviews to monitor compliance with the established standards. By doing so, organizations can safeguard their data integrity and make more informed decisions based on accurate information.

4. Choose The Proper BI Tools And Technologies:

Once you have evaluated your data and established a governance framework, it’s time to decide on the right BI tools and technologies that will help you process and analyze your data. These can range from simple spreadsheet programs to complex business intelligence dashboards, depending on the size and complexity of your organization’s data. It is crucial to consider factors such as cost, scalability, user-friendliness, and compatibility with existing systems when selecting BI tools.

5. Define Key Performance Indicators (KPIs) And Metrics To Measure Success:

To effectively measure the success of your BI strategy, it is important to define clear KPIs and metrics that align with your organization’s goals. These could include metrics such as revenue growth, customer satisfaction, or employee productivity. By regularly tracking and analyzing these key metrics, organizations can gain valuable insights into their performance and make data-driven decisions to improve their operations.

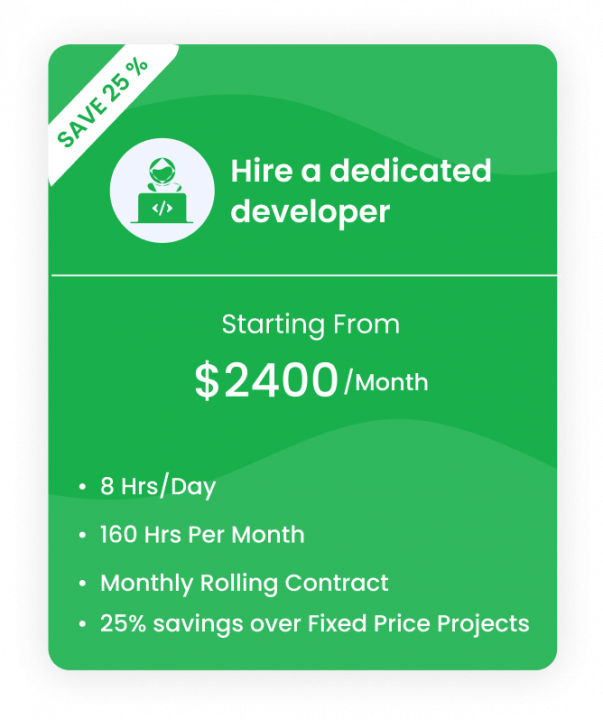

5. Hire and Build a Dedicated BL Team:

While having the right tools and data is crucial, it’s also important to have a skilled team that can effectively use this information to drive business decisions. This includes hiring data analysts, data scientists, and other BI professionals who are well-versed in utilizing various BI tools and technologies. Organizations should also invest in training and upskilling existing employees to build a dedicated BI team that can continuously monitor and analyze data for actionable insights.

6. Implement Records Integration And Consolidation:

One of the main challenges in implementing a successful BI strategy is dealing with siloed data. This occurs when different departments or systems collect and store data independently, making it difficult to get a complete view of the organization’s operations. Siloed data can lead to inconsistencies, data duplication, and a lack of collaboration across the organization.

To overcome this challenge, organizations should invest in integrating and consolidating their data sources. This involves centralizing all data into a single repository or data warehouse, allowing for more comprehensive analysis and reporting. A unified data platform can facilitate better data governance, ensure data accuracy, and provide a single source of truth for decision-making. Additionally, organizations should invest in data integration tools and technologies, and promote a culture of data-sharing and collaboration across departments to maximize the value of their BI strategy.

7. Establish a Sturdy Analytics Atmosphere:

The success of a BI strategy depends heavily on the organization’s ability to create a robust analytics environment. This involves investing in the right technology infrastructure, including hardware, software, and networking capabilities. Organizations should also ensure that data is securely stored, backed up regularly, and accessible to authorized users at all times. Moreover, it is crucial to establish clear processes and governance frameworks for managing data and creating reports or dashboards to ensure consistency and accuracy.

To enable an effective analytics atmosphere, organizations should also prioritize user-friendly tools and interfaces that allow business users to access and analyze data without extensive technical knowledge. User adoption is key to success in BI, and a complex or confusing analytics environment can hinder adoption rates and limit the potential impact of BI initiatives.

Furthermore, organizations should also consider investing in training programs to develop data literacy skills among employees. This will not only enhance their ability to use BI tools but also foster a data-driven culture within the organization, promoting better decision-making at all levels. By creating a sturdy analytics atmosphere, organizations can maximize the value of their BI strategy and drive business growth.

8. Foster an Information-driven Subculture:

In addition to establishing a strong analytics environment, organizations should also work towards creating an information-driven subculture. This involves instilling a mindset in employees that encourages the use of data and insights to drive decision-making processes.

To foster this subculture, organizations can regularly share success stories and positive outcomes resulting from data-driven decisions. This will showcase the value of BI initiatives and motivate employees to embrace a data-driven approach.

9. Establish a Center of Excellence:

A Center of Excellence (CoE) is a team or department within an organization that serves as a central hub for BI activities. The CoE is responsible for driving the overall strategy, governance, and best practices related to BI initiatives.

By establishing a CoE, organizations can ensure consistency and standardization in data management processes and promote collaboration across departments. This will not only improve the quality of insights but also streamline decision-making processes, leading to better business outcomes.

10. Continue to Screen and Optimize:

BI is an ongoing process that requires continuous monitoring and optimization. Organizations should regularly assess their BI strategy, tools, and processes to identify any gaps or areas for improvement.

This can be done through regular audits, gathering feedback from users, and staying updated on the latest trends and technologies in the BI industry. By continuously screening and optimizing their BI efforts, organizations can ensure that they are maximizing the value of their data assets and driving business growth. So, it is essential to keep learning and adapting in this ever-evolving field of Business Intelligence. With a well-established BI strategy combined with a data-driven culture, organizations can gain a competitive advantage and achieve long-term success.

11. Align With Commercial Enterprise Strategy:

Business Intelligence initiatives should align with the overall commercial enterprise strategy. This will ensure that BI efforts are focused on achieving specific business objectives and contributing to the overall growth of the organization.

By aligning BI with the company’s goals and vision, organizations can make data-driven decisions that support their long-term success. Additionally, this alignment will help in securing buy-in from stakeholders and top management, making it easier to secure resources and support for BI initiatives. So, it is essential to regularly review and adjust BI strategies to stay aligned with evolving business goals.

How can iTechnolabs help you Build a BI Strategy For Your Fintech Business?

At iTechnolabs, we offer comprehensive BI services that can help fintech businesses build an effective BI strategy. Our team of experts has extensive experience in implementing BI solutions for various industries, including finance and banking. We understand the unique challenges and opportunities faced by fintech companies and can tailor our services to meet your specific needs.

Our approach begins with a thorough assessment of your current BI capabilities and identifying areas for improvement. We then work closely with your team to define business objectives, identify key performance indicators (KPIs), and develop a roadmap for achieving your BI goals.

- Comprehensive Assessment: Conduct a thorough analysis of your current BI capabilities and identify areas for improvement.

- Custom Strategy Development: Collaborate with your team to define business objectives and tailor a BI strategy that aligns with your specific needs and goals.

- KPI Identification: Help identify and establish key performance indicators (KPIs) that will drive your business towards achieving its objectives.

- Data Integration: Ensure seamless integration of various data sources to enable a unified view of your business performance.

- Advanced Analytics: Implement advanced analytics and data visualization tools to provide actionable insights.

- Training and Support: Provide training to your staff to effectively use BI tools and offer ongoing support to ensure sustained success.

- Scalability: Develop scalable BI solutions that can grow with your business, adapting to changing needs and demands.

- Compliance and Security: Ensure your BI strategy adheres to industry standards and regulations, maintaining data security and compliance.

- Continuous Improvement: Regularly review and optimize BI strategies to remain aligned with evolving business goals and industry trends.

- Stakeholder Engagement: Facilitate stakeholder buy-in and support for BI initiatives to secure necessary resources and commitment.

Want a Business Intelligence Strategy for your fintech business?

Contact us!

Choosing iTechnolabs for building a BI strategy offers a multitude of benefits tailored specifically for the fintech sector. Firstly, domain expertise is a significant advantage; iTechnolabs’ vast experience in fintech ensures they understand the unique challenges and regulatory requirements of the industry, such as data privacy laws and financial regulations. This results in bespoke solutions that align perfectly with your specific needs, ensuring not only compliance but also optimized performance. Secondly, their end-to-end solutions encompass all key aspects of BI, from strategy development to implementation and continuous improvement. This includes detailed data analysis, intuitive dashboard creation, and comprehensive reporting.

- Custom Solutions: iTechnolabs crafts tailored BI solutions that are designed to meet the specific needs and challenges of fintech businesses, ensuring optimal alignment with industry requirements.

- Regulatory Compliance: With deep knowledge of fintech regulations, iTechnolabs ensures that all BI strategies adhere to data privacy laws and financial regulations, mitigating the risk of non-compliance.

- Expert Consultation: Leverage the expertise of iTechnolabs’ seasoned professionals who provide valuable insights and guidance throughout the BI strategy development process.

- Advanced Data Analysis: Benefit from sophisticated data analysis techniques that provide actionable insights, enabling informed decision-making and strategic planning.

- User-Friendly Dashboards: iTechnolabs creates intuitive and easy-to-navigate dashboards that present complex data in a comprehensible manner, empowering users at all levels to make data-driven decisions.

- Comprehensive Reporting: Gain access to detailed and comprehensive reports that streamline the evaluation of business performance and the identification of growth opportunities.

- Scalability: iTechnolabs designs BI solutions with scalability in mind, allowing the BI infrastructure to evolve with your business and adapt to changing market conditions.

- Ongoing Support: Receive continuous support and updates to ensure that BI tools remain effective and aligned with your business goals over time.

- Speed to Market: Accelerate the implementation of BI solutions with iTechnolabs’ efficient and streamlined processes, reducing time to market and enabling faster realization of benefits.

Important: Assessing the Cost to Build a Fintech App

Conclusion:

In today’s fast-paced and data-driven business landscape, having a solid BI strategy is essential for success. iTechnolabs offers comprehensive and tailored BI solutions that provide businesses with the tools they need to effectively analyze, manage, and utilize their data. With expert consultation, advanced data analysis techniques, user-friendly dashboards, comprehensive reporting, scalability, ongoing support, and efficient implementation processes, iTechnolabs helps businesses stay competitive and make informed decisions based on data-backed insights.

Frequently Asked Questions

What Is Business Intelligence (BI), And Why Is It Vital For Fintech Organizations?

Business Intelligence (BI) is a process of collecting, analyzing, and interpreting large amounts of data to gain insights into business operations and make informed decisions. In the fintech industry, where competition is fierce and data plays a crucial role in decision-making, BI can provide organizations with a competitive edge by identifying growth opportunities, optimizing processes, and improving overall performance.

Why Ought Fintech Marketers To Be Accomplices With Leading BI Carrier Providers Like Us?

As fintech marketers, it is essential to partner with leading BI providers like iTechnolabs to gain access to advanced BI tools and expertise. These partnerships can help businesses stay up-to-date with the latest industry trends, leverage cutting-edge technology, and make data-driven decisions that drive growth and success. Additionally, working with a reliable BI provider can save time and resources by streamlining processes and providing ongoing support.

What Is The Cost Of Implementing Business Intelligence In Fintech Business?

The cost of implementing BI in a fintech business can vary depending on factors such as the size and complexity of the organization, the type of BI tools and services required, and the level of customization. However, partnering with a reputable BI provider like iTechnolabs can help businesses optimize costs by offering scalable solutions tailored to their specific needs.

Can BI Assist Fintech Companies With Regulatory Compliance?

Yes, BI can play a crucial role in helping fintech companies comply with regulations and stay on top of industry standards. With the increasing focus on data privacy and security, BI tools can help organizations track and monitor sensitive data, generate compliance reports, and identify potential risks or areas for improvement. This not only ensures regulatory compliance but also builds trust with customers and stakeholders.

What Function Does Predictive Analytics Play In BI For Fintech?

Predictive analytics is a powerful tool that uses data, statistical algorithms, and machine learning techniques to identify future outcomes and trends. In the fintech industry, this can be particularly useful in detecting fraud or identifying potential customers for specific financial products or services. By leveraging predictive analytics through BI, fintech businesses can make smarter decisions, mitigate risks, and drive innovation. So, fintech marketers must understand the value of predictive analytics and incorporate it into their BI strategies.