As technology continues to evolve at an unprecedented pace, digital wallet applications have surged in popularity, favored for their unparalleled convenience and robust security features. These innovative mobile wallets provide a seamless way for users to store various payment methods, including credit and debit cards, loyalty cards, and even digital currencies, in one centralized, easily accessible location on their smartphones. This consolidation not only simplifies the purchase process but also significantly enhances transaction security, reducing the risk of physical card theft or loss.

With the rapid rise of contactless payments, fueled by public health considerations and the desire for quicker transaction times, along with the ever-increasing dominance of online shopping, digital wallets are swiftly becoming an indispensable tool for the modern-day consumer. They facilitate a smoother, more efficient shopping experience, both in-store and online, by enabling instant payments with just a tap or scan of a device, eliminating the need to carry and fumble through physical wallets for the right card. As more consumers recognize the convenience and security of digital wallets, their adoption is expected to continue growing, reshaping the way we think about personal finance and consumer transactions in the digital age.

The Best Digital Wallet Apps Market Share (US)

To accurately portray the landscape of digital wallet usage in the United States, it’s crucial to examine the market shares of the leading applications. According to recent studies, the top contenders in this space include PayPal, Apple Pay, Google Wallet, and Samsung Pay, each offering unique features tailored to diverse user needs. PayPal remains a frontrunner, largely owing to its early entry into the digital payments space and its widespread acceptance among online retailers. Apple Pay follows closely, benefitting from the loyalty of iPhone users and its integration into iOS devices, making it a convenient option for in-store and online payments. Google Wallet and Samsung Pay also hold significant portions of the market, with their flexibility across various devices and innovative payment solutions appealing to a broad audience. These digital wallets exemplify the dynamic and competitive nature of the market, reflecting the evolving preferences and behaviors of consumers in the digital age.

Also Read: A Comprehensive Guide to Building a Secure Mobile Wallet App Like Google Pay in 2024

10 Best Digital Wallet Apps for Android or iOS Platforms in 2024

1 – Apple Pay: Best for iOS Integration

As previously discussed, Apple Pay stands out as a leading option in the digital payment space, primarily due to its flawless integration with iOS devices, which enables users to enjoy a hassle-free experience when making both in-store and online payments. Another significant advantage of Apple Pay is the convenience it offers. Users don’t have to carry physical cards or cash, as everything is accessible with just a tap on their device. Furthermore, Apple Pay is renowned for its advanced security measures, including Face ID or Touch ID authentication, which provide an extra layer of protection for user information, ensuring that transactions are not only convenient but also highly secure. This combination of ease of use, convenience, and robust security features makes Apple Pay a top choice for iOS users looking to streamline their payment process.

Pros:

- Seamless Integration with iOS: Apple Pay is designed to work effortlessly with iOS devices, providing a smooth and intuitive user experience.

- High Security: Utilizes advanced security features like Face ID and Touch ID, significantly reducing the risk of unauthorized transactions.

- Convenience: Eliminates the need for physical wallets, allowing payments to be made simply by using an iPhone or Apple Watch.

Cons:

- Limited Acceptance Outside the US: While widely accepted in the United States, Apple Pay’s usability can be somewhat restricted in other countries.

- Dependency on Apple Devices: Only available to users within the Apple ecosystem, limiting its accessibility to Android or other smartphone users.

- Potential Privacy Concerns: While security is a strong suit, the centralization of financial transactions within a single tech giant raises privacy considerations for some users.

2 – Google Pay – Compatible with Both Android & iOS

Google Pay, formerly known as Android Pay, is a mobile payment service developed by Google. It is available on both Android and iOS devices, making it accessible to a wider range of users. Similar to Apple Pay, Google Pay utilizes near-field communication (NFC) technology for contactless payments. However, Google Pay also supports in-app purchases and peer-to-peer transactions.

Google Pay has a wide range of features that make it a popular choice for mobile payments. It offers convenience, security, and ease of use, making it a preferred payment method for many users.

Pros:

- Compatibility with Both Android and iOS: As mentioned earlier, Google Pay is available on both Android and iOS devices, making it accessible to a wider user base.

- In-App Purchases & Peer-to-Peer Transactions: In addition to contactless payments, Google Pay also supports in-app purchases and peer-to-peer transactions, providing users with a versatile payment platform.

- Easy Integration for Merchants: Google Pay has made integration easy for merchants, allowing them to accept payments seamlessly through their mobile apps or websites.

- Rewards & Loyalty Programs: Google Pay also offers rewards and loyalty programs for users, making it a lucrative option for frequent shoppers.

Cons:

- Limited Availability in Some Countries: While Google Pay is available in many countries, its availability can be limited in some regions, restricting users from utilizing its features.

- Incompatibility with Older Devices: Older devices may not have the necessary technology to support Google Pay, limiting its accessibility for some users.

- Dependence on Internet Connectivity: As a mobile payment service, Google Pay relies on Internet connectivity, making it unusable in areas with poor network coverage.

3 – Cash App – Beginner-Friendly Stock Trading App

Cash App is a popular mobile payment and financial services platform launched by Square Inc. in 2013. One of its notable features is the ability to buy and sell stocks directly within the app, making it a beginner-friendly option for those interested in investing.

Pros:

- Beginner-Friendly Interface: Cash App has a clean and user-friendly interface that makes it easy for beginners to navigate and understand.

- Low Minimum Investment Requirements: Unlike traditional trading platforms, Cash App allows users to invest in stocks for as little as $1, making it accessible to a wider range of users.

- Fractional Shares Support: Cash App offers fractional shares support, allowing users to purchase a portion of a stock rather than the entire share. This feature is beneficial for those with a limited budget or looking to diversify their portfolio.

- Instant Deposits and Withdrawals: Cash App offers instant deposits and withdrawals, allowing users to quickly access their funds without any delays.

Cons:

- Limited Stock Options: While Cash App does offer a variety of stocks to choose from, it may not have as many options compared to other trading platforms. This may limit the investment choices for users.

- Limited Research and Analysis Tools: Cash App does not offer extensive research and analysis tools, which may make it difficult for more experienced traders to conduct thorough market analysis before making investment decisions.

- Limited Customer Support: Cash App’s customer support is limited, with no phone or live chat options available. This may make it challenging for users to get immediate assistance in case of any issues or concerns.

- Limited Availability: Currently, Cash App’s stock trading feature is only available in the United States, limiting its accessibility to users worldwide.

4 – Venmo – Ideal for Peer-to-Peer Payment Network

Venmo is a popular peer-to-peer payment app that allows users to send and receive money from friends and family. In addition to its primary function, Venmo also offers a stock trading feature for its users. Similar to Cash App, Venmo’s stock trading feature has both pros and cons.

Pros:

- User-Friendly Interface: Venmo’s interface is user-friendly and easy to navigate, making it ideal for beginners or those new to stock trading.

- No Fees for Stock Trading: Venmo does not charge any fees for stock trading, making it a cost-effective option for those looking to invest in the stock market.

- Social Features: Venmo allows users to share their investments with their network of friends, providing a social aspect to stock trading and potentially creating a sense of community among users.

Cons:

- Limited Investment Options: Similar to Cash App, Venmo’s stock trading feature has limited investment options compared to traditional trading platforms. This may limit the choices for users when it comes to diversifying their portfolios.

- Limited Research Tools: Venmo does not offer extensive research tools for users to analyze potential investments, making it challenging for more experienced traders.

- No Customer Support: Venmo’s customer support is limited to email only, with no phone or live chat options available. This may make it challenging for users to get immediate assistance in case of any issues or concerns.

- Limited Availability: Currently, Venmo’s stock trading feature is only available to a select number of users, with plans for a wider rollout in the future. This may limit its accessibility for those who are interested in using this feature.

5 – Paypal – Ideal for Quick Transactions

Paypal, a popular online payment platform, also offers stock trading as part of its services. As one of the largest and most widely used digital payment systems, PayPal’s entry into stock trading has created a buzz in the financial industry.

Pros:

- Convenient Transactions: With millions of users worldwide and a reputation for secure transactions, using PayPal for stock trading can be a convenient and hassle-free option for investors.

- Intuitive Platform: Paypal offers a user-friendly platform for stock trading, making it easy for beginners to navigate and place trades.

- No Minimum Investment: Unlike traditional trading platforms that may require a minimum investment amount, PayPal allows users to start with as little or as much as they want.

Cons:

- Limited Investment Options: Paypal’s stock trading feature is currently limited to only US stocks, which may not appeal to users looking for more diverse investment options.

- Limited Research Tools: Similar to Venmo, PayPal also does not offer extensive research tools for investors to analyze potential investments.

- Higher Fees: Compared to other online brokerages, PayPal’s fees can be relatively higher, especially for larger trades.

- Limited Availability: As with Venmo, Paypal’s stock trading feature is also currently only available to a select group of users, limiting its accessibility. However, plans for a wider rollout are in the works.

6 – Zelle – A Fast and Secure Option for Bank Transfers

Zelle, another widely used digital payment system, stands out for providing a fast and secure method for executing bank transfers. It enables users to effortlessly send and receive money, facilitating direct transactions between bank accounts in just a matter of minutes. This convenience and efficiency make Zelle a preferred choice for those looking to manage their finances quickly and securely.

Pros:

- Instant Transfers: With Zelle, users can transfer funds instantly between participating banks, eliminating the need for lengthy wait times.

- No Additional Fees: Zelle does not charge any additional fees for bank transfers, making it a cost-effective option for users.

Cons:

- Limited Availability: Similar to Venmo and Paypal, Zelle is also currently only available to select users and banks. However, expansion plans are in the works.

- Incompatible with Some Banks: While Zelle is compatible with most major banks, it may not be available for all banks and credit unions.

- Lack of Consumer Protection: Unlike other digital payment systems, Zelle does not offer consumer protection in case of fraudulent transactions. Users should be cautious when sending money to unfamiliar recipients.

7 – Yono SBI – A Comprehensive Banking Solution

Yono SBI (You Only Need One), offered by the State Bank of India, is an all-in-one digital banking platform that provides a range of financial services to its users. From basic banking transactions to wealth management and bill payments, Yono SBI offers a comprehensive solution for managing all your financial needs.

Pros:

- Wide Range of Services: Yono SBI users have access to a vast array of services including savings account management, loan applications, insurance services, and investment options, all from one platform.

- Seamless Integration: Designed for ease of use, Yono SBI offers seamless integration with various financial products and services, making banking a hassle-free experience for users.

- High-Level Security: Yono SBI employs advanced security measures to protect user data and transactions, ensuring a safe banking environment for its customers.

Cons:

- Complex Interface for New Users: New users may find the platform’s interface complex and intimidating due to the multitude of available services and options.

- Occasional Technical Glitches: Some users have reported experiencing technical issues with the app, such as slow response times and transaction errors.

- Limited Global Functionality: While Yono SBI is a powerful tool for users within India, its services and functionalities are somewhat limited for international banking and transactions.

8 – Phone pe – Simplified Digital Payments

Phone pe is a popular digital wallet and payment platform in India. Launched in 2016, it has revolutionized the way people make transactions by providing a simple and secure solution for all their payment needs.

Pros:

- User-Friendly Interface: Phone pe offers a user-friendly interface that is easy to navigate, making it accessible for people of all ages and technical backgrounds.

- Fast and Convenient Transactions: With Phone pe, users can make quick and hassle-free transactions for a variety of services, including bill payments, mobile recharges, and online shopping.

- Secure Transactions: The app uses high-end security measures such as multi-factor authentication, to ensure the safety of user data and transactions.

Cons:

- Limited Acceptance: While Phone pe is accepted at a wide range of merchants and online platforms, it may not be available for use everywhere. This can be inconvenient for users who are unable to make payments through the app due to limited acceptance.

- Dependency on Internet Connectivity: As with any digital platform, Phone pe requires a stable Internet connection for transactions to take place. This can be a drawback for users who live in areas with poor connectivity or while traveling to remote locations.

9 – PayZapp – All-in-One Payment Solution

PayZapp is a leading digital wallet and payments app in India, developed by HDFC Bank. It offers a wide range of services, including mobile recharges, bill payments, travel bookings, and online shopping.

Pros:

- Multiple Payment Options: PayZapp allows users to link multiple payment methods such as credit/debit cards, net banking, and UPI to their account. This gives users the flexibility to choose their preferred mode of payment for transactions.

- Easy Accessibility: PayZapp is available on both iOS and Android platforms, making it easily accessible to a large number of smartphone users.

- Instant Cashback Offers: The app frequently offers attractive cashback deals and discounts on various transactions, making it a cost-effective option for users.

Cons:

- Transaction Charges: While PayZapp itself does not charge any fees for transactions, users may incur additional charges from their bank or service provider. This can add up to higher costs for regular users.

- Limited Merchant Acceptance: Unlike popular digital wallets like Paytm and Phonepe, PayZapp is not as widely accepted by merchants. This can be a drawback for users who want to make payments at offline stores or smaller vendors.

- Security Concerns: PayZapp has faced security breaches in the past, which have raised concerns about the safety of user data and transactions. This may deter some users from using the app for sensitive transactions.

10 – Samsung Pay

https://www.samsung.com/in/samsung-pay/Samsung Pay is a mobile payment and digital wallet service offered by Samsung Electronics. It allows users to make payments using their Samsung devices at any point-of-sale terminal that accepts contactless payments.

Pros:

- Wide Merchant Acceptance: Samsung Pay is accepted at most major retailers and even smaller merchants, making it a convenient option for users who want to use their phones for everyday transactions.

- Secure Transactions: Samsung Pay uses tokenization and biometric authentication to ensure secure transactions, giving users peace of mind when making payments.

- Rewards and Cashback Offers: The app offers various rewards and cashback deals, making it a cost-effective option for regular users.

Cons:

- Limited Device Compatibility: As of now, Samsung Pay is only available on select Samsung devices, limiting its reach to a specific user base.

- Incompatibility with Older Terminals: While most newer point-of-sale terminals support contactless payments, older ones may not be compatible with Samsung Pay. This can be inconvenient for users who frequently visit merchants that use older payment systems.

- Lack of Integration with Loyalty Programs: Unlike some other mobile payment apps, Samsung Pay does not integrate with loyalty programs. This means that users cannot earn loyalty points or rewards when making payments through the app.

Read More: Key Considerations and Top Features for Developing a Mobile eWallet App

How much does it cost to build a Digital Wallet?

The cost of building a digital wallet app can vary widely depending on several factors including features, platform (iOS, Android, or both), design complexity, security measures, and the region where the development is taking place. For a basic digital wallet app with core functionalities like account integration, secure payments, notifications, and customer support, the development cost can range from $20,000 to $50,000. For a more advanced app that includes additional features such as biometric authentication, loyalty programs, and advanced analytics, the cost can escalate to $100,000 or more. Additionally, ongoing costs for maintenance, updates, and compliance with financial regulations should also be considered, which could amount to 15-20% of the initial development cost annually.

- Basic Digital Wallet App Costs: The price range for developing a basic digital wallet application typically falls between $20,000 to $50,000. This estimation covers core functionalities that are essential for a minimal viable product, including account integration, which allows users to link their bank accounts or credit cards; secure payments, ensuring that all transactions are encrypted and protected; notifications to keep users informed about their transaction status and account alerts; and customer support to assist users with any issues or questions they may have.

- Advanced Digital Wallet App Costs: For businesses looking to offer more sophisticated features, the cost can escalate to $100,000 or more. These additional features might include biometric authentication, providing an extra layer of security through fingerprint or facial recognition; loyalty programs, which encourage users to continue using the app by offering rewards; and advanced analytics, giving businesses insights into user behavior and transaction patterns.

- Ongoing Maintenance and Compliance Costs: After the initial development, maintaining the app is crucial for its smooth operation and relevance. Annually, businesses may need to allocate 15-20% of the initial development cost for maintenance, which includes fixing any bugs, updating the app to keep it compatible with new operating system versions, and adding new features. Additionally, compliance with financial regulations is essential to ensure that the app meets legal standards and protects user data, which also requires ongoing attention and resources.

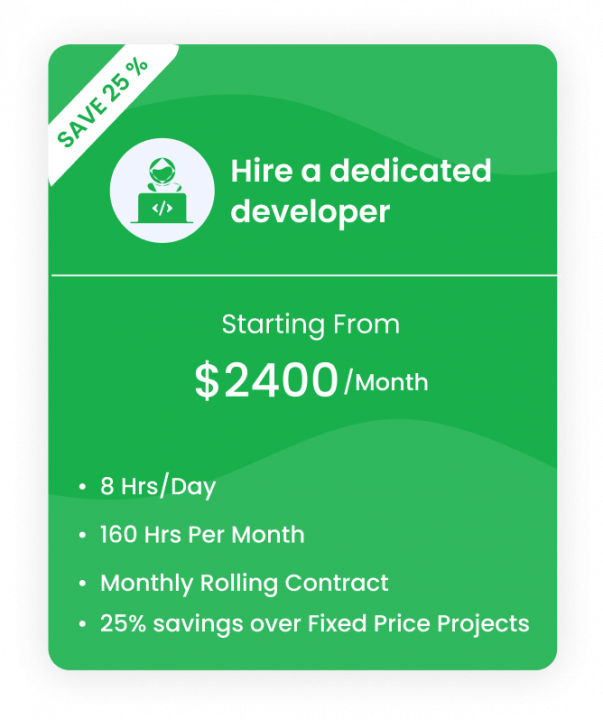

- Regional Cost Variations: The cost of developing a digital wallet app can also vary significantly depending on the region where the development team is located. For example, development teams in North America and Western Europe tend to have higher rates due to the higher cost of living and operating costs in these regions. In contrast, teams in Eastern Europe, Asia, and Latin America may offer more competitive rates. This variation in development costs can have a significant impact on the overall budget for the project, making it important for businesses to carefully consider where they choose to develop their app.

Suggested: How Much Does it Cost to Create An App

How can iTechnolabs help you to build digital wallets?

iTechnolabs is a leading fintech app development company that specializes in creating customized solutions for businesses. Our team of experienced mobile app developers and designers can help you build a robust digital wallet app that meets your specific needs and budget.

We offer end-to-end development services, including market research, UI/UX design, feature development, testing, deployment, and maintenance. With our extensive experience in developing fintech solutions, we understand the unique challenges and requirements of building a successful digital wallet app.

Our team also stays updated with the latest development trends and regulations in the finance industry to ensure that your app is compliant and secure. Additionally, our global presence allows us to offer competitive rates without compromising on quality.

- Customized Solutions: Tailor your digital wallet app to your unique business needs and goals, ensuring a perfect fit for your target audience.

- Comprehensive Development Services: Benefit from a full range of services, from market research and UX/UI design to feature development, testing, deployment, and ongoing maintenance.

- Expert Team: Leverage the knowledge and experience of a team skilled in fintech solutions, ready to address the specific challenges and requirements of your digital wallet app.

- Up-to-date Practices: Count on a partner who stays abreast of the latest trends and regulations in the finance sector to ensure your app is both compliant and cutting-edge.

- Global Competitive Rates: Take advantage of our global presence which allows for cost-effective rates without sacrificing quality, enabling a budget-friendly approach to development.

- Security and Compliance: Rest assured that your app will be developed with the highest standards of security and compliance, incorporating best practices to protect user data and transactions.

Are you looking for digital wallet development services?

Choosing iTechnolabs as your partner for developing digital wallets brings unparalleled advantages. With our deep-rooted expertise in the fintech sector, we not only provide tailor-made solutions that align perfectly with your business objectives but also ensure these solutions are innovative and user-centric. Our comprehensive development process, which covers everything from meticulous market research to the deployment of advanced features, and rigorous testing to post-launch maintenance, guarantees a product that is not just robust and secure but also highly scalable. This thorough approach ensures your digital wallet app remains relevant and competitive in the fast-evolving financial landscape. Additionally, our commitment to staying ahead of industry trends and regulations means your app will be built to last, ready to adapt to future changes in the finance sector. By partnering with iTechnolabs, you’re not just developing an app; you’re investing in a solution that will grow with your business, enhancing user engagement, and driving financial success.

- Expertise in Fintech: iTechnolabs brings a wealth of knowledge and experience in the fintech sector, ensuring that your digital wallet is developed with industry-leading insights and practices.

- Customizable Solutions: Tailored specifically to meet your business objectives, our solutions are designed to be flexible, meeting the unique needs of your project.

- Innovative Features: We incorporate the latest in technology and innovation to make sure your digital wallet stands out, offering users a seamless and enriched experience.

- Scalability: Our designs are built for growth, ensuring that as your user base expands, your digital wallet can easily adapt and scale to meet increasing demands.

- Rigorous Security Measures: With a strong emphasis on security and compliance, we provide peace of mind by implementing best practices to protect user data and financial transactions.

- Comprehensive Support: From initial concept to post-launch, we provide continuous support and maintenance, ensuring your digital wallet operates smoothly and efficiently.

- Future-Proof: By staying ahead of technology trends and regulatory changes, we build digital wallets that are not only effective today but are poised to adapt and thrive in the future.

Important: Creating Your Own Crypto Trading Bot

Conclusion:

With iTechnolabs as your partner, you can be confident that your digital wallet will not only meet your current needs but also can grow and evolve alongside your business. Our expertise in fintech, customizable solutions, innovative features, scalability, rigorous security measures, comprehensive support, and future-proof approach make us the ideal choice for developing a successful digital wallet solution. Trust us to deliver a cutting-edge digital wallet that will elevate your business and provide an exceptional user experience for your customers.

Frequently Asked Questions

How can I make my digital wallet popular?

There are a few key factors that can contribute to the success and popularity of a digital wallet. Some important considerations include having a user-friendly interface, offering seamless and secure transactions, providing innovative features and services, and effectively marketing your digital wallet to reach potential users. Partnering with an experienced and reputable fintech company like iTechnolabs can also greatly enhance the chances of your digital wallet becoming popular.

Why does my business need to adapt digital wallet payments?

There are several reasons why businesses should consider implementing digital wallet payments. Firstly, it allows for a more convenient and streamlined transaction process for customers, which can improve customer satisfaction and loyalty. Additionally, the use of digital wallets can also reduce operational costs for businesses by eliminating the need for physical cash handling and processing fees associated with traditional payment methods. Furthermore, as technology continues to evolve, digital wallet payments are becoming the preferred method of payment for many consumers, making it essential for businesses to adapt to stay competitive in the market.

How can I select the best digital wallet app development company?

When choosing a digital wallet app development company, there are a few key factors to consider. Firstly, it is important to research the company’s experience and expertise in developing digital wallets. Look for companies that have a track record of successful and innovative projects in this field. Additionally, consider their technology stack, as well as their ability to customize solutions according to your specific business needs. It is also important to consider their security measures and compliance with industry standards. Finally, look for a company that offers ongoing support and maintenance services to ensure the smooth functioning of your digital wallet.

What is the future of mobile wallets?

The future of mobile wallets is bright and constantly evolving. With the rise of smartphone usage, the adoption of digital wallet payments is expected to continue to increase in the coming years. This trend can also be attributed to the growing demand for contactless and secure payment methods, especially in light of recent events such as the COVID-19 pandemic.