Introduction

In recent years, the financial technology industry has experienced a remarkable surge in growth and innovation, leading to a fundamental transformation of the financial services landscape. Notably, one of the key developments in this arena is the rise of robo-advising platforms. These advanced digital advisory solutions harness sophisticated algorithms to offer automated investment suggestions and personalized portfolio management services, thereby revolutionizing the efficiency and convenience of investment management processes. With their intrinsic cost-effectiveness, user-friendly interface, and streamlined operational approach, robo-advisors have rapidly gained popularity among a wide range of users. This includes not only individual consumers seeking tailored financial guidance but also financial institutions looking to enhance their investment strategies and elevate client services to unprecedented standards. The increasing adoption of robo-advisors signifies a shift towards more tech-driven and personalized financial solutions in the ever-evolving realm of finance and investment.

What is a Robo-Advisor and How Does it Work?

At its core, a robo-advisor is an artificial intelligence-based digital platform that automates investment management functions typically performed by human financial advisors. These platforms employ advanced algorithms to analyze user data and generate personalized investment recommendations based on the investor’s financial goals, risk tolerance, and time horizon.

Investor Input:

To get started, an investor first needs to input their financial information and preferences into the robo-advisor platform. This may include factors such as income, expenses, desired asset allocation, and investment objectives. Some platforms may also ask for personal details like age, marital status, and dependents to further customize recommendations.

Algorithmic Portfolio Creation:

Once the investor’s information is input, the robo-advisor uses its algorithms to create a diversified portfolio tailored to their needs. These portfolios typically consist of a mix of low-cost exchange-traded funds (ETFs) or index funds that align with the investor’s risk profile and goals.

Continuous Monitoring and Adjustments:

One of the key features of robo-advisors is their ability to continuously monitor and adjust portfolios based on market changes. The algorithms use real-time market data and other factors like economic conditions and investor behavior to make necessary adjustments to the portfolio’s asset allocation. This ensures that the portfolio remains aligned with the investor’s goals and risk preferences.

Benefits of Robo-Advisor Platform Development for an Investment Firm

The rise of robo-advisors has not only made investing more accessible for individuals but also brought various benefits to investment firms. Here are some advantages of developing a robo-advisor platform for an investment firm:

Cost-Effective Solutions

One of the primary benefits of robo-advisors for investment firms is their cost-effectiveness. Building and maintaining a robo-advisor platform requires significantly less resources compared to traditional human advisors. This allows investment firms to provide financial advice and portfolio management services at a lower cost, making it more accessible for clients with smaller investment portfolios. Moreover, automation reduces the need for human labor, resulting in lower overhead costs for the firm.

No Minimum Account Balances

Traditionally, investment firms set stringent requirements for clients, mandating a specific minimum account balance for service access. This practice limited opportunities for individuals with modest capital. In contrast, robo-advisors revolutionized the industry by eliminating these barriers, enabling even those with limited funds to enjoy professional portfolio management and financial guidance. This inclusive approach not only benefits individuals but also opens doors for investment firms to tap into a broader clientele, fostering growth and widening their customer base.

Real-Time Analytics and Advice

Robo-advisors, utilizing sophisticated algorithms and cutting-edge artificial intelligence technology, have revolutionized the way market data is analyzed in real-time. By leveraging these capabilities, they offer clients timely and data-driven investment advice, significantly enhancing the efficiency and effectiveness of portfolio management processes.

In contrast to human advisors, who are constrained by time and resources, robo-advisors have the unique ability to continuously monitor the market landscape. This allows them to swiftly identify promising investment opportunities and potential risks, ensuring that portfolios are adjusted promptly and optimally. The seamless integration of real-time analysis and automated advice provision not only enhances the value delivered to clients but also elevates the overall performance standards of investment firms, setting a new benchmark for excellence in the industry.

Emotion-Free Decision-Making

Another significant advantage of robo-advisors is their ability to make rational and objective investment decisions, free from human emotional biases. Traditional advisors are prone to making impulsive or biased decisions influenced by factors such as personal beliefs, past experiences, or current sentiments. In contrast, robo-advisors base their recommendations solely on data-driven analysis, eliminating the risk of human emotions clouding investment judgments.

Moreover, by negating the effects of human biases, robo-advisors can provide consistent and objective advice to clients, ensuring a high level of transparency and trust in the investment process. This also minimizes the potential for conflicts of interest between advisors and clients, further strengthening the integrity of the advisory relationship.

Comprehensive Documentation and Reporting

In addition to providing unbiased and timely investment advice, robo-advisors also excel in generating comprehensive documentation and reporting for clients. This includes detailed reports on portfolio performance, asset allocation, historical data analysis, and future projections. These reports are available on-demand through user-friendly dashboards or can be automatically sent to clients periodically.

The availability of such detailed documentation not only empowers clients to make informed decisions but also increases their satisfaction and confidence in the advisory service. It also serves as a valuable resource for clients to track their progress towards financial goals and make necessary adjustments as needed.

Also Read: Role of AI in Logistics and Supply Chain

Key Features of the Robo-Advisor Platform

In summary, the key features of a robo-advisor platform include:

Automatic Rebalancing

Robo-advisors harness the power of cutting-edge algorithms to autonomously fine-tune and readjust portfolios in accordance with the client’s specific investment objectives and risk tolerance thresholds. This methodical approach guarantees that the portfolio stays in harmony with the desired asset allocation, providing resilience and enhancement even amidst shifting market conditions and fluctuations. Through the utilization of these advanced technologies, investors can capitalize on a forward-thinking and flexible investment strategy that not only optimizes returns but also adeptly manages risks, offering a comprehensive approach to wealth management.

Portfolio Management

Along with automatic rebalancing, robo-advisors also provide efficient portfolio management services that cater to the diverse needs of clients. Highly skilled professionals rigorously monitor and analyze market trends in real-time, leveraging cutting-edge tools and technology. This continuous monitoring enables the system to proactively make well-informed decisions promptly, ensuring that clients’ investments are strategically aligned with their financial goals. By maintaining a keen eye on market conditions, robo-advisors can swiftly adapt the portfolio to any significant changes, guaranteeing optimal diversification and performance tailored to each client’s unique investment objectives.

Risk Tolerance Assessment

Robo-advisors, powered by cutting-edge technology, leverage advanced risk assessment tools to deeply analyze an individual’s risk tolerance levels and investment preferences. These thorough evaluations play a crucial role in establishing highly tailored asset allocation strategies, ensuring that the portfolio aligns perfectly with the client’s unique risk appetite and financial objectives.

This innovative feature not only provides clients with a heightened sense of security but also nurtures a profound peace of mind. Clients can rest assured knowing that their investments are meticulously crafted to meet their distinct needs and preferences, fostering a robust and trusting advisor-client relationship built on personalized financial guidance and tailored investment strategies.

Asset Allocation Strategies

Robo-advisors employ sophisticated algorithms to analyze vast amounts of data and generate optimal asset allocation strategies with a level of precision that traditional human advisors often cannot match. Multiple factors such as risk tolerance, investment goals, time horizon, and market conditions are considered when creating customized portfolios for clients. This approach allows for a more diversified and efficient allocation of assets, maximizing returns while minimizing risk.

Furthermore, robo-advisors offer access to a wide range of investment options, including stocks, bonds, exchange-traded funds (ETFs), and alternative investments. This diverse selection allows investors to build a well-balanced portfolio that suits their risk profile and aligns with their long-term financial goals.

Investment Analytics and Tracking

Another significant advantage of robo-advisors is their ability to provide detailed investment analytics and tracking. Clients can easily monitor the performance of their investments in real-time, receiving regular updates on portfolio growth and asset allocation changes. This level of transparency allows for informed decision-making and provides clients with a comprehensive understanding of their financial standing.

Moreover, these platforms often offer advanced tools and visualizations, such as risk assessment charts and asset correlation graphs. These features provide clients with a deeper understanding of their portfolio’s performance, helping them make more informed investment decisions.

Tax-Loss Harvesting

Robo-advisors provide a tax-efficient investment strategy known as tax-loss harvesting. In this approach, investments that have incurred losses are sold and substituted with similar assets (though not identical) to counterbalance gains in different parts of the portfolio. This method aims to help investors minimize their tax obligations while upholding the desired asset allocation across their investments. By leveraging tax-loss harvesting, investors can optimize their tax efficiency and potentially enhance their long-term investment returns.

Diversification and Risk Management

Robo-advisors also offer diversification and risk management strategies that cater to the individual risk tolerance of clients. This is done by building a portfolio with a mix of various asset classes, such as stocks, bonds, real estate investment trusts (REITs), and commodities.

Diversification helps mitigate the risk associated with investing in a single asset class and provides a buffer against market volatility. Robo-advisors use algorithms to analyze clients’ risk tolerance and financial goals to recommend a personalized asset allocation that aligns with their preferences.

Investor Education and Guidance

In addition to investment management, many robo-advisors also offer educational resources and guidance to help investors better understand their investments. Some platforms provide articles, videos, and webinars on various financial topics, such as retirement planning, asset allocation strategies, and market trends.

Moreover, some robo-advisors offer access to certified financial planners or licensed advisors who can answer questions and provide personalized advice. This level of support can be beneficial for individuals who are new to investing or want additional guidance on their portfolio.

Rebalancing

Maintaining a well-balanced portfolio is essential for long-term investment success. Robo-advisors offer automatic portfolio rebalancing to ensure that the asset allocation remains in line with the initial recommendations and the client’s risk tolerance.

Rebalancing involves selling investments that have grown in value and buying more of those that have decreased in value. This strategy helps investors stay disciplined and avoid making emotional decisions based on market fluctuations.

Tax Optimization

Taxes play a crucial role in influencing investment returns, making tax optimization a fundamental component in effective investment management. One common tax optimization strategy utilized by many robo-advisors is tax-loss harvesting.

Tax-loss harvesting involves strategically selling investments that have incurred losses to counterbalance taxable gains in other segments of the portfolio. By implementing this strategy thoughtfully, investors can potentially reduce their tax liabilities, leading to a significant improvement in their overall returns on investments. Ultimately, mastering tax optimization strategies can pave the way for enhanced financial growth and success in the realm of investment management.

Components of a Robo-Advisor

A robo-advisor typically consists of three main components: the algorithm, the portfolio optimization engine, and the user interface. These components work together to provide a comprehensive investment management solution for clients.

Frontend for Customers

The user interface serves as the central hub for clients to engage with their robo-advisor. It empowers clients to establish precise investment objectives, define their risk tolerance, and input comprehensive financial data. Moreover, through the frontend, clients can actively track and evaluate their portfolio’s performance. Additionally, the interface grants access to a wide array of educational materials and tools designed to assist in monitoring progress towards achieving sustainable long-term financial goals.

Money Management Algorithms

Robo-advisors harness the power of sophisticated algorithms to swiftly examine and assess a client’s financial data. These advanced algorithms meticulously take into account various crucial factors such as the client’s age, diverse income sources, specific investment objectives, and levels of risk tolerance. By intricately analyzing this wealth of information, the algorithms can precisely pinpoint the optimal portfolio allocation customized to suit the unique financial profile of each individual client. Through these detailed and personalized analyses, robo-advisors provide tailored investment recommendations that are finely calibrated to meet the specific requirements and aspirations of their clients, ensuring a comprehensive and client-centric approach to financial planning.

Financial APIs

Robo-advisors often integrate financial APIs (application programming interfaces) to enable smooth and efficient interactions between various software systems, applications, and databases. These APIs facilitate the seamless transfer of data between clients’ accounts and their robo-advisor, ensuring swift execution of investment strategies. By leveraging these APIs, robo-advisors can continuously monitor market fluctuations and make real-time adjustments to client portfolios, ensuring optimal performance at all times. The use of financial APIs also allows robo-advisors to access a vast and diverse range of investment options, providing clients with more opportunities to diversify their portfolios and maximize returns.

Backend System Management

Behind the scenes, robo-advisors rely on highly sophisticated backend systems to efficiently manage and automate various tasks, including intricate data analysis, meticulous portfolio rebalancing, and precise trade execution. These advanced systems leverage cutting-edge machine learning and artificial intelligence algorithms to continuously analyze market trends, adapt investment strategies, and optimize performance. By meticulously monitoring and adjusting investments, robo-advisors ensure that clients’ portfolios are consistently aligned with their financial objectives in the dynamic market landscape. Furthermore, the utilization of robust backend systems empowers robo-advisors to provide seamless round-the-clock services, offering clients the flexibility and convenience to oversee their investments at any given time.

Portal for Partnerships

Robo-advisors, in addition to their technological prowess, also provide an extensive partnership portal tailored for financial institutions. These institutions encompass a wide range, from traditional banks to sophisticated wealth management and brokerage firms. Within this portal, partners are invited to engage in a collaborative effort with robo-advisors, granting their clientele access to state-of-the-art investment technologies and cutting-edge strategies.

This collaboration acts as a gateway for financial institutions to meet the escalating demand for automated investment solutions, simultaneously elevating their service spectrum and broadening their customer outreach. The support extended by robo-advisors to their partners is multifaceted, offering services such as white-labeling opportunities, personalized investment strategies, and a suite of marketing resources. This symbiotic relationship proves to be a mutually beneficial alliance, enriching the capabilities of both parties involved.

Read More: How to Build an App Like Character AI: AI Chatbot

How to Build a Robo-Advisor Platform?

Building a robo-advisor platform requires an intricate understanding of the financial market landscape, along with advanced technological expertise. The process involves multiple stages and requires collaboration from various teams, including finance experts, developers, designers, and legal advisors.

Discovery Phase

The discovery phase is vital in laying the foundation for a successful robo-advisor platform. This critical stage involves conducting thorough market research to deeply understand customer preferences and needs. It also includes an extensive analysis of the existing market landscape, pinpointing key competitors and their strategic approaches. Furthermore, this phase encompasses the development of a unique value proposition that not only sets the platform apart from competitors but also deeply connects with the target audience, thus cultivating a strong competitive advantage in the market. During this phase, it’s crucial to gather insights from various data sources and engage in collaborative efforts to ensure all aspects are meticulously examined and considered for strategic decision-making.

Proof of Concept

After completing the discovery phase, it is crucial to move on to creating a proof of concept (POC) to offer a tangible representation of the robo-advisor platform. This POC serves as a preliminary version that not only demonstrates the product’s capabilities and features but also allows stakeholders to provide valuable feedback and validation. Additionally, the POC presents an ideal opportunity to experiment with and enhance critical elements like data aggregation techniques, investment algorithms, and user interface design. By acting as a pivotal stage in the development process, the POC enables the early identification of potential flaws or areas in need of refinement, ensuring a more robust and efficient final product.

Design and Development

Once the POC (Proof of Concept) is successfully created, the design and development phase can kick off. This pivotal stage revolves around translating the valuable insights derived from thorough market research and the POC into a highly functional robo-advisor platform. The process entails the creation of crucial features like automated portfolio management, robust risk assessment tools, diverse customizable investment options, and intuitively designed user interfaces. Furthermore, this stage demands meticulous testing to guarantee the platform’s reliability, scalability, and seamless compatibility across a wide array of devices and operating systems.

Development of Strategic Partnerships

In today’s dynamic financial landscape, robo-advisors need to be equipped with diverse investment options and strategies. To offer such versatility, partnering with industry-leading investment firms and fund managers is crucial. These strategic partnerships not only allow the platform to boast a diverse range of investment options but also provide valuable insights and expertise in designing highly efficient algorithms for auto-investing. Additionally, strategic partnerships can also serve as a means of leveraging existing customer bases and expanding the reach of the robo-advisor platform.

Deployment and Maintenance

Once the design and development phase is successfully completed and strategic partnerships are firmly established, the next crucial step is to meticulously deploy the robo-advisor platform. This deployment process includes thorough testing procedures to ensure that all features operate precisely as intended before the platform is launched for public access. Subsequently, continuous maintenance and updates become imperative to adapt to market trends, regulatory shifts, and evolving customer demands. Regular monitoring and fine-tuning of the platform are essential not only to sustain its competitiveness in the market but also to deliver users a consistently seamless and gratifying experience.

How Much Does It Cost to Make a Robo-Advisor?

The cost of developing a robo-advisor platform is influenced by numerous factors, including the complexity of its algorithms, the scale of its investment options, the depth of integration with financial partners, and the robustness of its security measures. Preliminary estimates suggest development costs can range from $100,000 to $500,000. However, this figure could significantly increase depending on additional features, like advanced AI capabilities, integration with various payment systems, and compliance with global financial regulations. Maintenance and update costs should also be accounted for, which could add an additional 15-20% to the total development cost annually.

Suggested: How Much Does it Cost to Create An App

Use of White-Label Components or Custom Development

The use of white-label components can significantly reduce development costs and speed up the deployment process. White-label software refers to pre-built, customizable platforms that developers can license and integrate with their brand’s identity. This approach can save time and money for companies looking to enter the robo-advisor market quickly. However, customization options may be limited, and there is a risk of using a one-size-fits-all solution that may not fully meet the company’s specific needs. On the other hand, custom development allows for complete control over the platform’s design and functionality but can significantly increase costs and development time.

Integration with Existing Banking Infrastructure

Another factor to consider when developing a robo-advisor platform is the integration with existing banking infrastructure. This includes connecting with financial institutions, such as banks and brokerage firms, to facilitate transactions and access investment options for clients. The level of integration required will depend on the company’s target market and their specific needs. For example, a robo-advisor targeting high-net-worth individuals may need more robust integration capabilities than one catering to small investors. Integration with banking infrastructure can add additional costs to the development process, but it is essential for providing a seamless experience for users.

Number and Type of Front Ends (Mobile/Web)

The number and type of front ends, specifically mobile and web interfaces, are also crucial considerations in robo-advisor development. With the increasing use of smartphones and tablets, a mobile app is almost a necessity for any financial service. Having a user-friendly and functional mobile interface can improve the overall user experience and attract a wider audience. However, developing separate front ends for both mobile and web can significantly increase costs. Careful consideration must be given to the target audience and their preferred method of accessing the platform to determine the optimal number and type of front ends.

Addition of Specific Features and Services

The features and services offered by a robo-advisor can vary greatly, from basic portfolio management to more advanced tax-loss harvesting and socially responsible investing options. As the competition in the market grows, it becomes necessary for companies to differentiate themselves by offering unique features and services. However, each additional feature or service will add to the development time and costs. It is crucial to carefully consider the target market and their specific needs before deciding on which features and services to include in a robo-advisor platform.

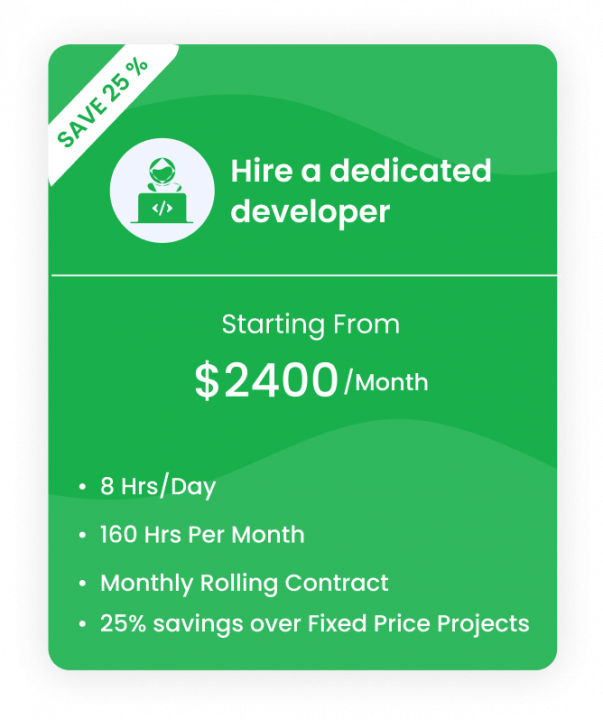

How Can iTechnolabs Help You Empower Your Business with a Robo-Advisor Platform?

iTechnolabs is a leading software development company that specializes in building cutting-edge robo-advisor platforms for businesses of all sizes. With our expertise in financial technology and years of experience, we can help you create a powerful and user-friendly platform that can revolutionize your business.

Our team of skilled developers and designers will work closely with you to understand your specific requirements and tailor a robo-advisor platform that serves your unique needs. We use the latest technologies and development methodologies to ensure that your platform is robust, secure, and scalable.

Moreover, our team constantly stays updated with industry trends and regulations to ensure that your platform is compliant with all legal requirements. We also offer ongoing maintenance and support services to keep your platform running smoothly and efficiently.

- Customized Solutions: At iTechnolabs, we pride ourselves on offering customized solutions tailored to meet your unique business objectives. Our team ensures that the robo-advisor platform is not just aligned with your goals but also caters specifically to your target audience, enhancing user engagement and satisfaction.

- Expert Team: Our dedicated team consists of seasoned financial technology specialists who bring a wealth of experience to the table. From the initial stages of development to the final launch, our experts are committed to providing comprehensive guidance and support, ensuring a smooth and successful journey for your platform.

- Advanced Technologies: By harnessing the power of cutting-edge technologies, we go beyond mere innovation to deliver platforms that are both groundbreaking and secure. Our focus on data security guarantees the protection of user information and assets, instilling confidence in your platform’s reliability and trustworthiness.

- Scalability: Recognizing the dynamic nature of businesses, we prioritize scalability in our platform designs. Our solutions are built to grow alongside your business, effortlessly adapting to accommodate evolving user demands and ensuring seamless scalability without compromising performance.

- Compliance Assurance: Regulatory compliance is a cornerstone of our approach at iTechnolabs. Our team remains vigilant about staying up-to-date with the latest financial laws and regulations, ensuring that your platform adheres to all compliance standards. You can trust us to keep your platform in full compliance with industry requirements.

- Ongoing Support: Beyond the initial launch, iTechnolabs is committed to providing continuous support and maintenance services. Our proactive approach enables us to address any challenges promptly, keeping your platform operating at peak performance and ensuring a superior user experience.

Are you planning to build a Robo-Advisor like platform?

Choosing iTechnolabs for Robo-Advisor like Platform Development, brings numerous advantages, positioning your project for success in the highly competitive digital finance arena. Our seasoned experts leverage their comprehensive knowledge and experience to craft solutions that are not only innovative but also attuned to your business’s unique needs. With a commitment to using advanced technologies, we ensure that your Robo-Advisor platform is at the forefront of technological advancements, offering features that are both sophisticated and secure. Our emphasis on scalability means that as your business grows and evolves, your platform can easily adjust to new market demands without any hitches, protecting your investment over the long term. Furthermore, our rigorous adherence to compliance and regulatory standards provides peace of mind, safeguarding your platform against potential legal challenges. Lastly, our promise of ongoing support guarantees that your platform remains cutting-edge, with continuous enhancements for an optimal user experience. In sum, partnering with iTechnolabs ensures a robust, compliant, and future-proof Robo-Advisor platform that stands out in the financial technology landscape.

- Cutting-Edge Technology Integration: iTechnolabs prides itself on integrating cutting-edge technologies into the development of Robo-Advisor platforms. By leveraging state-of-the-art tools, the platforms not only ensure efficiency but also offer advanced features that cater to the evolving requirements of modern investors.

- Tailored Solutions for Optimal Business Alignment: Our customized development approach focuses on tailoring the platform to your business’s specific needs. By aligning the platform with your unique objectives and target market preferences, we ensure that it effectively meets your business goals and enhances user engagement.

- Scalable Architecture for Future Growth: The platform’s scalability is a core aspect of our design strategy. With a focus on accommodating your business’s growth trajectory, the platform allows for seamless scaling to meet future market demands without the need for extensive redevelopments, ensuring continued operational efficiency.

- Robust Security Protocols: Emphasizing the importance of data security, iTechnolabs implements advanced security features to protect both the platform and user data. Our robust protection measures instill confidence in users and mitigate potential cybersecurity risks, ensuring a safe and secure environment for financial transactions.

- Regulatory Compliance and Risk Mitigation: Our commitment to regulatory adherence guarantees that your platform complies with the latest financial regulations and standards. By mitigating legal risks and upholding compliance requirements, we foster trust among stakeholders and ensure a transparent and compliant operational framework.

- Dedicated Post-Launch Support Services: Our continuous support and maintenance services extend beyond the platform’s launch date. With a focus on addressing any issues promptly and ensuring optimal performance, we provide ongoing assistance to keep the platform up-to-date and operating at peak efficiency.

- Multi-Disciplinary Expertise: Gain access to a diverse team of professionals with expertise in technology and finance. Our seasoned professionals bring a wealth of knowledge to the table, ensuring that the product is not only technologically advanced but also financially robust, delivering a comprehensive solution that meets your business requirements effectively.

Important: A Complete Guide to Automated Crypto Trading Bot

Conclusion:

In conclusion, iTechnolabs offers a comprehensive and cutting-edge solution for financial institutions looking to establish their online presence. With our expertise in technology and finance, we strive to deliver a secure, scalable, and compliant platform that meets the ever-evolving needs of the market. Our commitment to post-launch support ensures sustainable growth and continued operational efficiency for your business. Choose iTechnolabs for a seamless and hassle-free transition to a digital financial platform. Keep up with the latest trends and regulations in the market with our services, so you can focus on what truly matters – your customers. Trust iTechnolabs for all your financial technology needs.

FAQ’s

What is a robo-advising platform?

A robo-advising platform represents a contemporary digital financial solution that leverages cutting-edge technology and intricate algorithms to provide clients with automated portfolio management services. By harnessing advanced algorithms, these platforms have the capability to swiftly and accurately analyze extensive datasets, customizing investment strategies to cater to individual requirements. This innovative methodology not only guarantees effective portfolio management but also frequently accompanies cost-effective fees, rendering it a compelling choice for individuals in search of a hands-off investment experience. The seamless integration of technology and finance in these platforms ensures a user-friendly experience, allowing investors to navigate the complexities of the financial world with ease and confidence.

How much does it cost to develop a robo-advisor app?

The cost of developing a robo-advisor app can vary based on the specific features and functionalities you wish to incorporate into your platform. Factors such as customization options, integration with external systems, and advanced analytics capabilities can influence the overall development cost. Typically, the price range for creating a robo-advisor app falls between $50,000 to $200,000, but this can fluctuate depending on the complexity of the project.

When considering the investment in your app’s development, it is crucial to emphasize the importance of partnering with a skilled development team that specializes in financial technology. By ensuring that your team has a strong background in fintech, you can enhance the quality of your app and set it up for long-term success in the competitive market.

At iTechnolabs, we pride ourselves on offering competitive pricing for our robo-advisor app development services. Our team is dedicated to delivering high-quality solutions that prioritize both functionality and security, helping you create a robust platform that meets your business objectives effectively.

Do robo-advisors make money?

Yes, robo-advisors do make money through various revenue streams. The primary source of income for robo-advisor platforms is the management fee charged to investors based on a percentage of their total assets under management. This fee can range from 0.25% to 0.50%, making it more affordable compared to traditional human advisors who typically charge between 1% to 2%.

Additionally, robo-advisors can also generate revenue through referral fees from partnering with other financial institutions and by offering premium services such as tax-loss harvesting or access to human advisors for a higher fee. As the popularity of robo-advisor apps continues to grow, so does their potential for generating profits.

How long does it take to develop a robo-advisor app?

The time it takes to develop a robo-advisor app can vary depending on the complexity of the project and the development team’s expertise. Typically, it can take anywhere from 3-6 months for basic features to be developed and up to a year for more advanced features.

At iTechnolabs, our experienced team of fintech developers follows an agile development methodology, ensuring a streamlined and efficient process. We work closely with our clients to understand their specific requirements and deliver a high-quality app within the agreed-upon timeline.