Getting loans in the UAE can be a long and tedious process, especially for expats who may not be familiar with the local banking system. Traditional banks often have lengthy procedures that require extensive paperwork and documentation, which can be overwhelming and time-consuming. This can include everything from proof of income and employment to various identification documents.

Have you heard? The usage of instant cash loan apps in UAE has surged by an impressive 20%! In recent years, quick loan apps have gained popularity across the UAE due to their convenience and speed. These innovative applications are designed to streamline the borrowing process, offering instant cash loans with minimal requirements. Users can complete the entire application process on their smartphones, often receiving approval within minutes.

In the first quarter of 2026, the Gulf’s leading banks saw an average loan growth of 7.5%, driven by sustained loan demand and elevated interest rates, which bolstered their profits. Notably, Dubai-based Emirates NBD achieved a record-breaking net income of $1.82 billion, marking the highest quarterly earnings among its peers.

This ease of access allows many individuals, particularly those who may struggle with the traditional banking system, to secure credit when they need it most. As a result, instant loan apps in UAE are not only transforming the landscape of personal finance in the UAE but also making financial support more accessible to a wider audience.

Instant Loan Apps in UAE: 20 Best Apps for Cash Loan

| Instant Loan Apps | iOS Rating | Android Rating | Key Features |

| Cash Now | 4.2 | 4.0 |

|

| LNDDO | 4.0 | 3.8 |

|

| Credy Loan | 3.9 | 4.1 |

|

| Cash U | 4.1 | 3.9 |

|

| FinBin | 4.3 | 4.2 |

|

| Cash App | 4.5 | 4.4 |

|

| IOU Financial | 3.8 | 3.7 |

|

| Flexxpay | 3.9 | 3.6 |

|

| EZ Money | 4.0 | 4.0 |

|

| Mashreq UAE | 4.4 | 4.3 |

|

| Emirates NBD | 4.3 | 4.2 |

|

| Citibank UAE | 4.1 | 4.0 |

|

| Payit | 4.5 | 4.4 |

|

| RakBank | 4.2 | 4.1 |

|

| Liv Bank | 4.6 | 4.5 |

|

| Tabby | 4.3 | 4.2 |

|

| ADCB Hayyak | 4.1 | 4.0 |

|

| E & Money | 4.4 | 4.3 |

|

| Payby Mobile Payment | 4.5 | 4.4 |

|

| Simplylife | 4.3 | 4.2 |

|

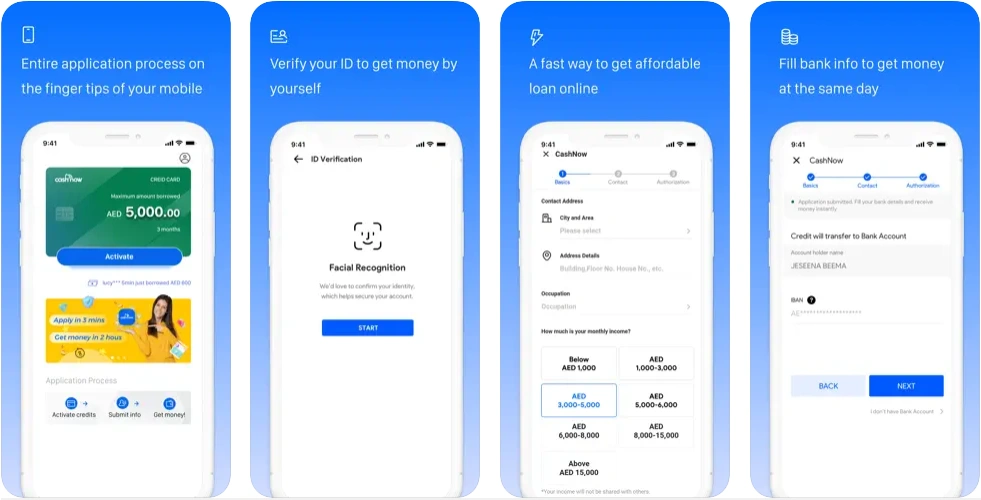

1. Cash Now – Loan Apps in UAE

The Cash Now app stands out in the fast-paced realm of quick cash loan apps in UAE, becoming a leading choice for rapid cash solutions when urgent financial needs arise. Among user-friendly instant loan apps in UAE, it offer unparalleled service allowing you to initiate quick requests for immediate funding with excellent efficiency.

Ideal for unexpected health expenses, unforeseen costs, or urgent financial challenges, the Cash Now app prioritizes ease and convenience. With a few simple taps on your device, it swiftly addresses your monetary needs, making it one of the most reliable options for financial assistance in the UAE.

Key Features:

- Instant cash disbursement

- Minimal documentation

- Quick approval process

2. LNDDO – Instant Loan App in UAE

LNDDO stands out as a UAE quick loan app authorized by the Financial Service Regulatory Authority to provide loans within the region. It has quickly become a popular choice for offering personal and short-term cash loans to individuals and small businesses. This instant loan app in UAE boasts a swift and uncomplicated loan process, with funds being disbursed within a week of completing the online application. Impressively, LNDDO does not require any collateral or documentation, streamlining the borrowing experience significantly.

Key Features:

- SME-focused loans

- Quick application process

- Flexible repayment terms

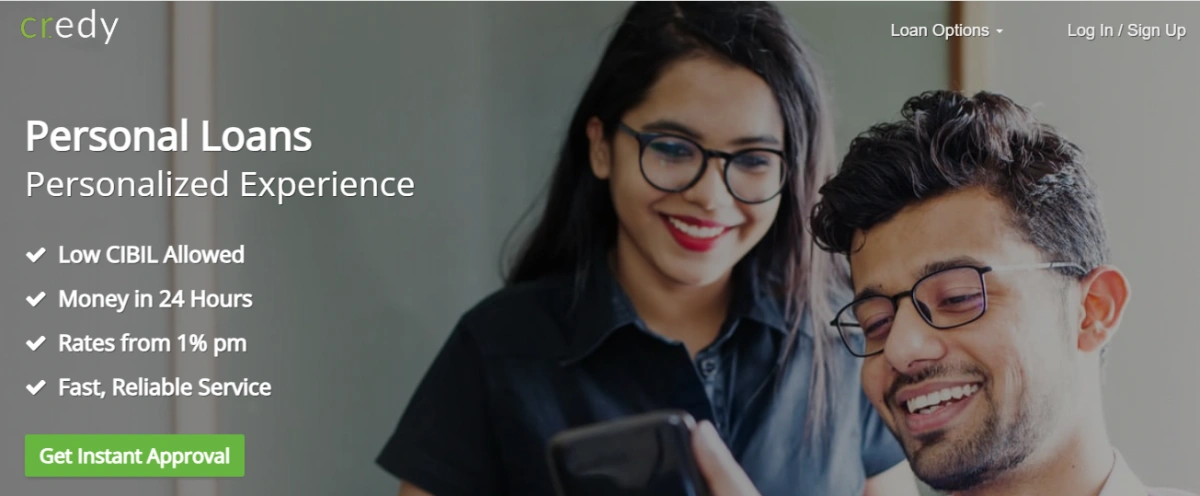

3. Credy Loan – Quick Cash Loan App UAE

Credy Loan has quickly become a popular choice in the UAE for its versatility in offering personal loans, credit card financing, and business loans. Designed by an expert team of mobile application developers in Dubai, the app is praised for its user-friendly interface. One of Credy’s key advantages is its swift loan disbursement process, which takes only a few minutes. It caters to diverse financial needs such as medical expenses, home renovations, and business investments. Additionally, Credy provides flexible repayment options, enhancing its appeal as a convenient and quick cash loan apps in UAE.

Key Features:

- Easy application process

- Quick turnaround

- No hidden fees

4. Cash U – Loan App in UAE

CashU is another urgent loan apps in UAE, known for its excellent user experience. Similar to the previously mentioned apps, it provides adaptable loan repayment plans, simplifying financial choices for users. The app promises robust security and ensures that it manages your funds while adhering to appropriate regulatory standards. CashU’s offerings make it an accessible tool for UAE residents to acquire loans and repay them on their preferred schedule. This flexibility makes it an ideal option for individuals and businesses seeking quick financial support in the UAE.

Key Features:

- Fast loan approval

- Low-interest rates

- Secure transactions

5. FinBin – Urgent Cash Loan in UAE

Ranked fifth on our list of urgent cash loan apps in UAE, FinBin provides immediate and cost-effective cash loans. What sets FinBin apart is its advanced algorithm, which rapidly evaluates your loan eligibility to present an offer specifically suited to your requirements. The app features an intuitive user interface, making it simple to navigate. Both businesses and individuals are invited to access affordable and urgent cash loans with assurance and simplicity. Additionally, FinBin offers its users a customizable repayment plan to suit their financial situations.

Key Features:

- Instant loan approvals

- Customizable repayment plans

- Minimal paperwork

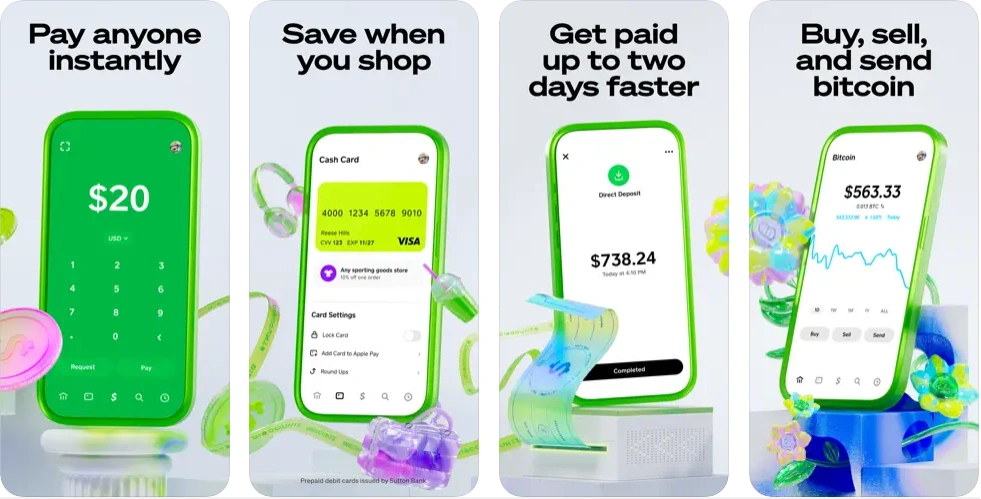

6. Cash App – Fast Loan App in UAE

Cash App provides a range of financial services, including personal loans, business loans, and credit card refinancing. Known for its effortless application process, users can complete their applications quickly and receive funds without delay. This instant loan apps in UAE emphasizes a user-friendly repayment schedule, allowing borrowers to repay their loans at a convenient pace. Serving both individuals and small businesses, Cash App ensures fast and straightforward access to cash loans, solidifying its position as a practical option for those seeking financial solutions in the UAE.

Key Features:

- Peer-to-peer payments

- Investing options

- Banking services

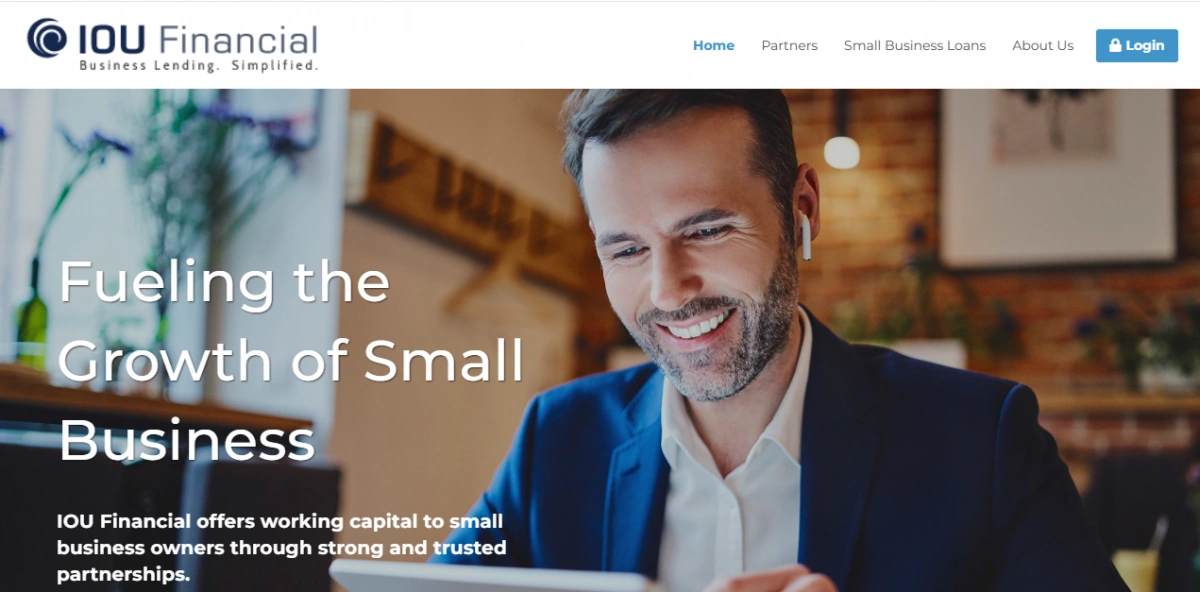

7. IOU Financial – IOU Loan App UAE

The next app on our list for quick cash loans in the UAE is IOU Financial, which boasts a user-friendly interface and efficient algorithms that swiftly evaluate your loan eligibility. This app provides instant cash loans in UAE, ensuring minimal waiting time. IOU Financial is crafted to allow users to easily track their repayment progress and manage their financial obligations effectively. It caters to both short-term and long-term borrowing needs in the UAE market, offering versatile loan solutions.

Key Features:

- Small business loans

- Fast access to funds

- Easy application process

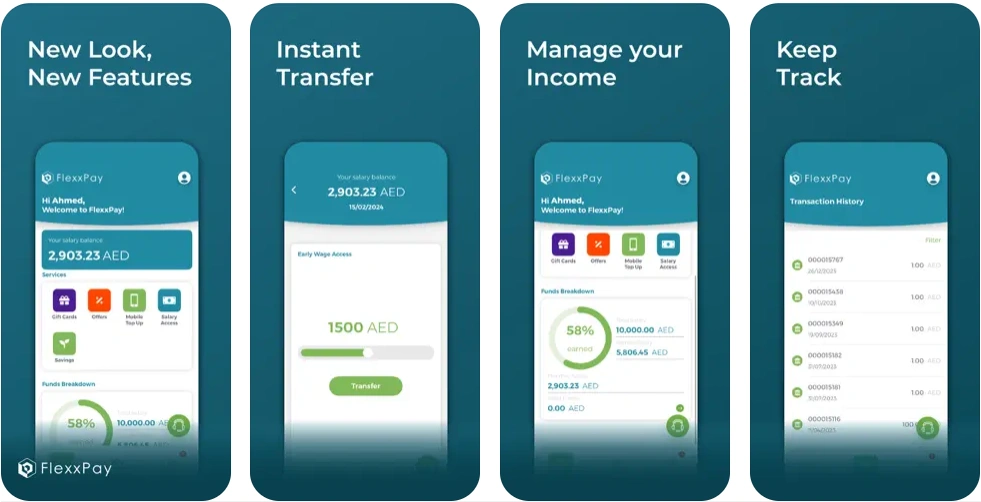

8. Flexxpay – Cash Loan App UAE

Flexxpay is an emerging instant loan apps in UAE that is quickly gaining traction among users. What distinguishes Flexxpay from other apps is its ability to provide quick cash loans up to AED 10,000. The app features an easy-to-navigate interface designed for a smooth user experience. According to the app, its procedures are highly transparent, and it commits to disbursing loans within just one day. Catering to both businesses and individuals across the UAE, Flexxpay offers substantial urgent cash loan options to meet diverse financial needs.

Key Features:

- Flexible borrowing limits

- Competitive rates

- Simple mobile application

9. EZ Money – Instant Loan App in UAE

Another noteworthy instant loan apps in UAE is EZ Money, which asserts its capability to provide cash loans reaching up to AED 10,000. Similar to the other intant cash loan apps mentioned, EZ Money boasts an intuitive user interface that simplifies the process of securing loans, managing them, and repaying with ease. This quick loan app is designed with a focus on simplicity and dependability, making it particularly appealing to UAE residents and tourists alike who may need access to fast and convenient loans at any time.

Key Features:

- Quick cash availability

- Transparent terms

- 24/7 customer support

10. Mashreq UAE – Easy Loan App UAE

Mashreq UAE stands out with its cutting-edge approach to loan app systems and is highly regarded as a reputable quick loan app in Dubai UAE. It specializes in delivering instant cash loans to both individuals and small businesses. One of Mashreq’s key strengths is its swift loan approval process paired with adaptable repayment plans, allowing borrowers the ease of repaying according to their preferences. What really distinguishes Mashreq is its loyalty program, which rewards users with points for completing various activities, enhancing customer retention and satisfaction.

Key Features:

- Comprehensive banking services

- Mobile banking capabilities

- Easy loan application

11. Emirates NBD – Loan App in UAE

Emirates NBD is another prominent option for obtaining urgent cash loans in the UAE, boasting a loan approval time of just 24 hours. It stands out as one of the largest instant loan apps in UAE on our list, offering quick cash amounts up to AED 200,000. However, an interest rate of 14.99% presents a potential challenge for some users who seek more affordable options. With a valuation of $3.89 billion, this app incorporates a Direct Debit System and services individuals between 21 and 65 years old. Unlike many competitors, Emirates NBD requires applicants to have a minimum monthly income of $5,000 to qualify for non-salary transfer loans. To proceed with a loan approval, applicants must provide documents such as a passport, Emirates ID, visa, and either bank statements or salary certificates.

Key Features:

- Wide array of financial products

- Digital banking services

- Custom loan solutions

12. Citibank UAE – Legit Loan Apps in UAE

Another notable app on our list is Citibank, which provides dependable loan services in the UAE. Citibank boasts competitive interest rates and eliminates processing fees, positioning itself as one of the most cost-effective loan solutions in the region. It employs a distinctive algorithm designed to assess creditworthiness, which helps ensure fair and accessible lending options. Additionally, Citibank is committed to safeguarding financial and personal information, reinforcing its reputation as a secure app for loans in the United Arab Emirates.

Key Features:

- Extensive banking options

- Competitive loan rates

- Global presence

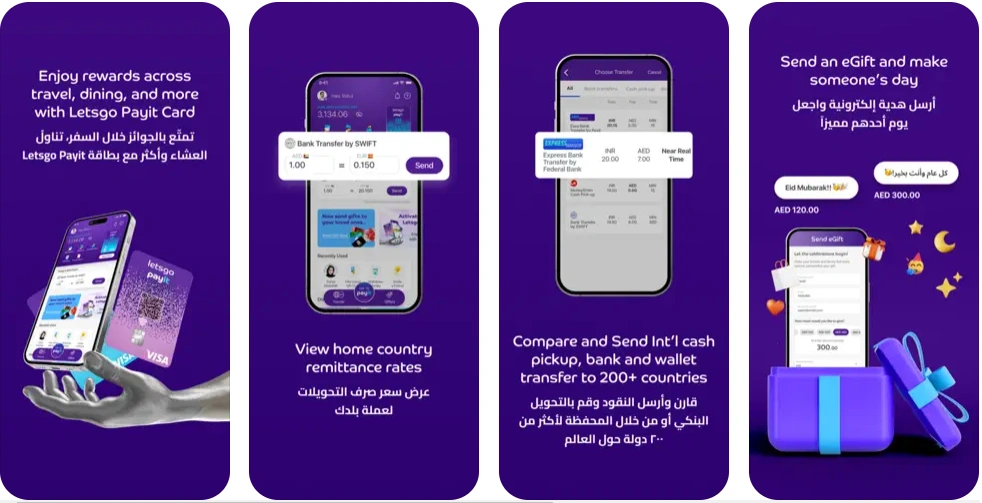

13. Payit – Quick Cash Loan App UAE

Payit promises swift loan approvals that happen in mere minutes. This quick loan app in UAE is tailored to provide flexible lending options that suit each individual’s financial needs. In addition, Payit offers financial guidance to aid users in making informed decisions. The platform is designed to assist both individuals and businesses in managing unforeseen expenses or investment opportunities. Furthermore, Payit emphasizes user-friendly repayment terms, making it easier for customers to pay back their loans promptly and without undue stress.

Key Features:

- Easy mobile transactions

- Seamless integration

- User-friendly interface

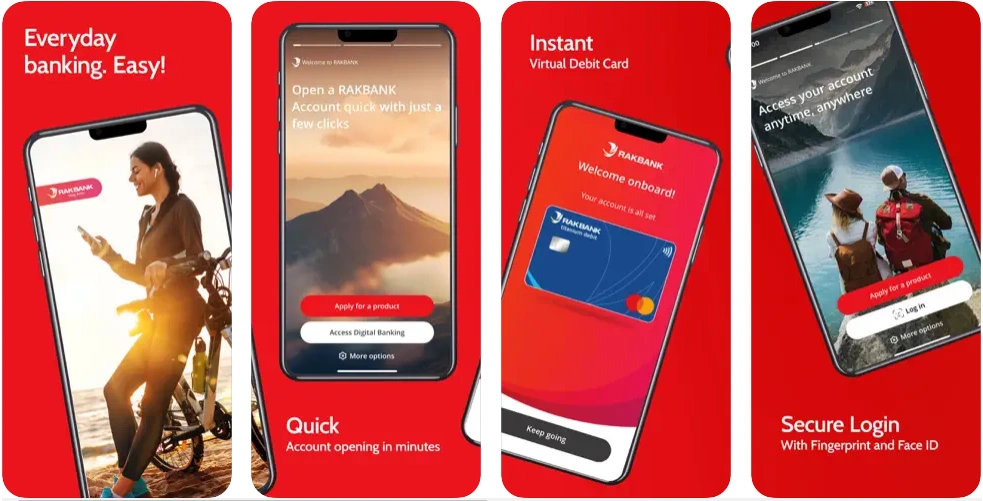

14. RakBank – Loan App in UAE

The RakBank App functions as an urgent cash loan apps in UAE with versatile tool for the residents of Dubai, primarily aimed at assisting users in managing their finances efficiently and planning their savings. By leveraging AI smart assistants, it offers personalized insights into financial habits and decisions. In addition to these capabilities, the app provides rapid cash loan services across the UAE. Setting itself apart from other applications, RakBank prioritizes financial literacy, empowering individuals to comprehend and manage their finances with ease through AI and educational resources. Moreover, it extends loans and financial support to both small businesses and individuals.

Key Features:

- Diverse loan products

- Advanced mobile banking features

- Quick processing times

15. Liv Bank – Loan Apps in UAE

Liv Bank is a popular choice for those seeking quick cash loans in UAE. Offering loans of up to AED 20,000, it markets itself as an ideal solution for individuals in need of smaller amounts to handle daily expenses. This instant loan app in UAE provides flexible repayment options, allowing users to choose terms ranging from 12 months to 4 years, based on their needs. With an annual interest rate of 8.99%, Liv Bank focuses on simplicity and transparency, striving to be user-friendly and straightforward for anyone seeking loans in the UAE.

Key Features:

- Digital banking excellence

- Instant account services

- Personalized financial management

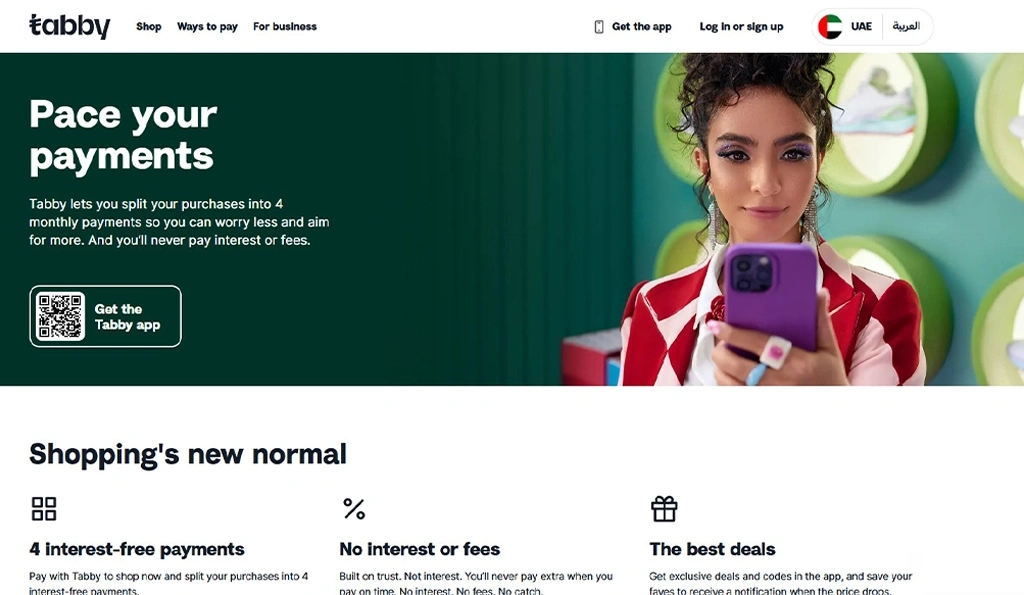

16. Tabby – Instant Loan App in UAE

The Tabby Cash Loan app in UAE brings a distinctive option to users who may not have the full upfront amount available but wish to purchase high-cost gadgets or electronics. With Tabby UAE, you’re given the convenience of spreading your payments over four months. When you make a purchase, you need only to cover a quarter of the item’s total price initially. Furthermore, the Tabby Cash Loan app serves as an immediate loan solution in the UAE, providing interest-free payment plans with minimal verification requirements.

Key Features:

- Buy now, pay later option

- Easy checkout process

- No hidden charges

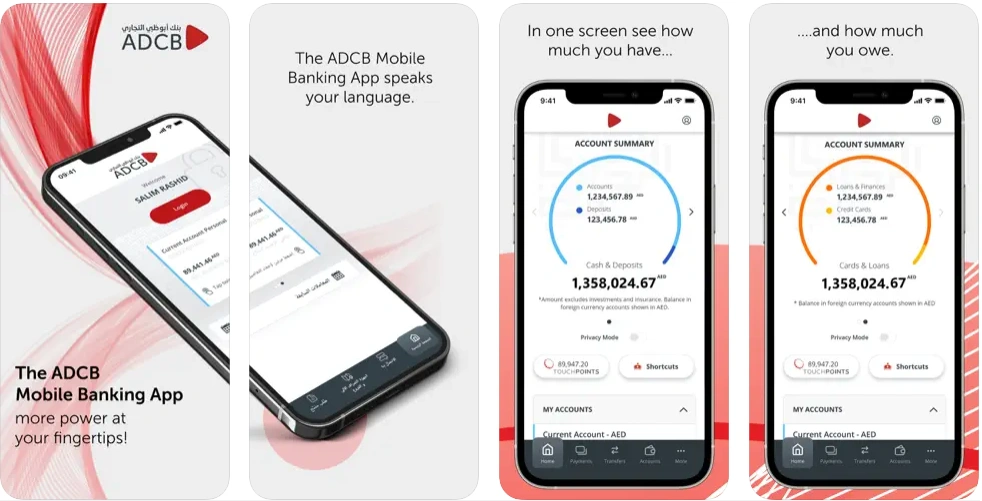

17. ADCB Hayyak – Cash Loan App UAE

Imagine a scenario where accessing immediate loans is as simple as waving a magic wand. That is exactly what the ADCB Hayyak loan app in UAE promises. With a single tap on the “Borrow” button within the ADCB Hayyak app, you can effortlessly communicate your lending needs. The magic doesn’t stop there—a loan calculator assists you in choosing options that best suit your needs. Once the process is complete, a brand new ADCB Hayyak account is instantly created. And where do the funds go? Right into your account! It’s time to harness your financial superhero powers.

Simply request your employer to deposit your salary directly into your ADCB account each month and follow it up with a confirmation letter—it’s that simple! With ADCB by your side, you can rely on their loan capabilities whenever you need them most. Offering access to both your monthly income and any end-of-service benefits, they serve as your ultimate guardian in loan management in today’s financial landscape.

Key Features:

- Effortless account opening

- Full banking services

- Smart financial insights

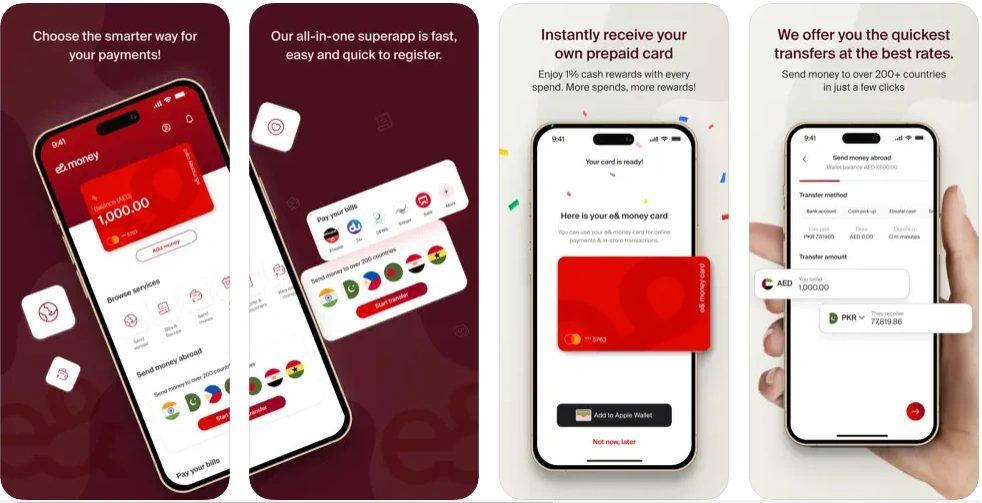

18. E& Money – E& Money Loan App

E& Money stands as a leading force in the UAE’s online loan market, offering quick cash advances with remarkable ease. The app streamlines the loan application process, allowing users to effortlessly apply and receive funds without any hassle. Whenever unexpected expenses arise, E& Money is there to alleviate your financial worries by swiftly providing the necessary cash. Searching for instant loan in UAE? Rest easy with E& Money, as it ensures your financial needs are promptly addressed. With the app’s straightforward procedures and user-friendly experience, managing your finances becomes simple with a reliable cash loan apps in UAE.

Key Features:

- Efficient financial management

- Seamless application process

- Secure platform

19. Payby Mobile Payment – Loan Apps in UAE

Have you ever dreamed of having a cash loan app in UAE that seamlessly integrates with mobile payments? Meet Payby UAE Mobile Payment, the leading app in the lending arena that revolutionizes borrowing through the magic of mobile transactions. This Payby loan app offers unmatched convenience. Simply submit a loan request for the Payby cash loan, and in mere moments, funds are transferred directly to your mobile wallet. The setup process is quick and straightforward, ensuring rapid access to cash whenever needed. It has emerged as the go-to option for anyone in search of speedy financial support in the UAE as if you have a clever assistant ensuring your funds are available wherever you are!

Key Features:

- Instant cash loans

- Hassle-free mobile integration

- Rapid fund transfer

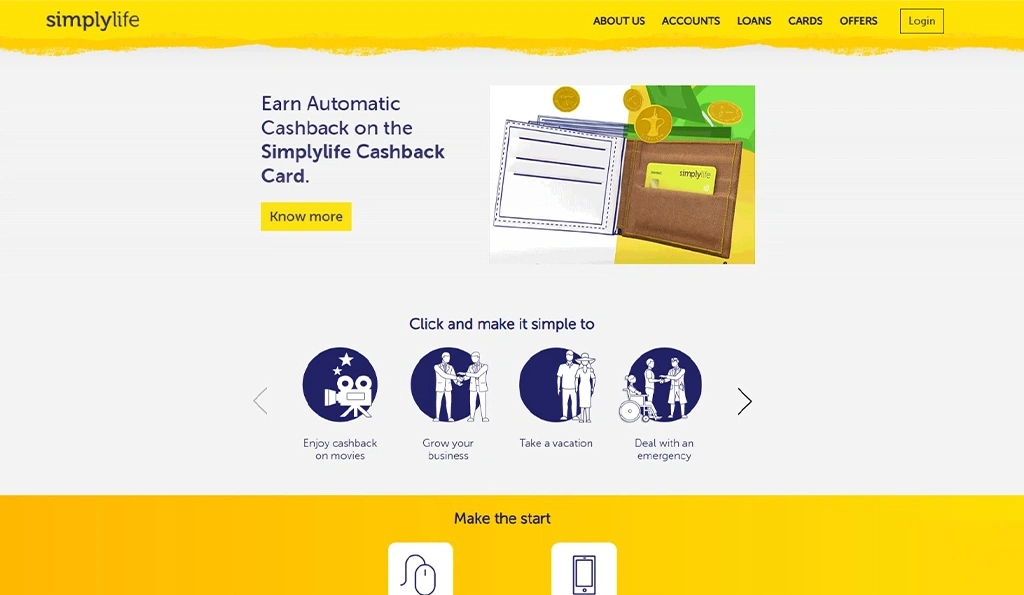

20. Simplylife – Instant Loan App in UAE

Simplylife is a top choice in the UAE for securing instant cash loans, offering a specialized call-back service for urgent situations. To receive immediate help, you simply need to text ’emergency’ to 2626. One of the key benefits of the Simplylife app is that it allows early loan repayment without imposing extra charges. Additionally, borrowers have the opportunity to access up to AED 500,000 with a repayment term of up to four years, provided they transfer their salary through this platform.

Key Features:

- Emergency loan service

- Penalty-free early repayment

- Substantial loan amounts

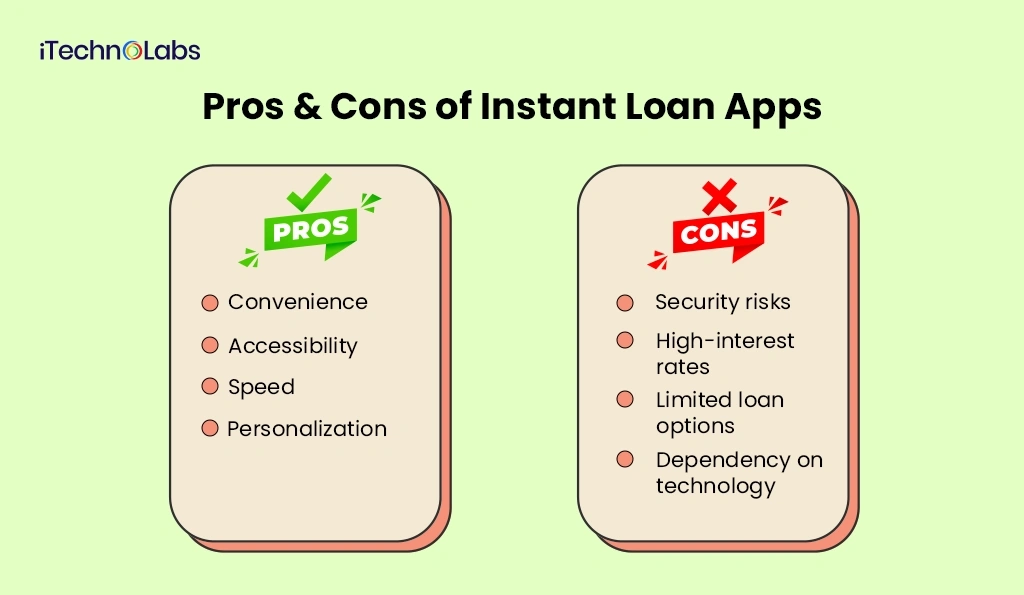

Pros & Cons of Instant Loan Apps

Pros:

- Convenience: Loan apps offer a quick and easy way to apply for loans, eliminating the need to visit a physical branch and fill out lengthy paperwork.

- Accessibility: These apps can be accessed 24/7 from anywhere with an internet connection, making it more convenient for users.

- Speed: Loan approval and disbursal processes are usually faster with loan apps compared to traditional methods.

- Personalization: Some loan apps use data analytics to personalize loan offers based on an individual’s credit score and spending habits, increasing the chances of getting approved for a loan.

Cons:

- Security risks: With the increase in online fraud and identity theft, using instant loan apps may pose a security risk for personal and financial information.

- High-interest rates: Some loan apps may have higher interest rates compared to traditional loans, making it more expensive in the long run.

- Limited loan options: Loan apps may not offer a wide range of loan options, limiting the borrower’s choices.

- Dependency on technology: Technical issues or glitches with the app can cause delays or difficulties in managing loan accounts.

Benefits of Using Finance App Development Services

There are several benefits to using finance app development services, including:

- Customized Solutions: Finance app development services offer customized solutions tailored to the specific needs and requirements of your business. This ensures that the app meets all your business goals and objectives.

- Cost-Efficient: Outsourcing finance app development can be a cost-efficient option compared to hiring an in-house team. It eliminates the need for additional resources such as office space, equipment, and employee benefits.

- Expertise and Experience: Finance app development companies have a team of experienced professionals with expertise in developing secure, user-friendly, and high-performing apps. They stay updated with the latest technology trends and can provide innovative solutions for your business.

- Faster Time to Market: With a dedicated team working on your finance app, you can expect a quicker turnaround time and faster time to market. This allows you to reach your target audience sooner and gain a competitive edge in the market.

- Maintenance and Support: Finance app development services also provide ongoing maintenance and support for your app, ensuring that it stays up-to-date and runs smoothly. This removes the burden of constantly monitoring and updating the app from your business operations.

- Security Measures: When developing financial apps, security is of utmost importance. Finance app development companies have strict data protection measures in place to ensure the safety of sensitive user information.

How Can iTechnolabs Help You with Instant Loan App Development in the UAE?

At iTechnolabs, we understand the importance of having a high-quality and secure finance app for your business. Our team of mobile app development dubai experts specializes in developing loan lending apps that cater to your specific requirements and goals. We have years of experience in the industry and stay updated with the latest technology trends to provide innovative solutions.

We strive to provide cost-efficient services by eliminating the need for additional resources and providing a faster time-to-market for your app. Our maintenance and support services ensure that your app runs smoothly at all times, leaving you free to focus on other aspects of your business.

- Expert Evaluation: Our team rigorously evaluates various instant loan apps available in the UAE to identify the ones that best match your requirements in terms of features, usability, and reliability.

- Customized Recommendations: We provide tailored recommendations based on your business needs and target audience, ensuring you receive a solution that fits perfectly with your objectives.

- Security Assurance: We assess the security measures in place within these loan apps to ensure they meet high standards of data protection and safeguard sensitive information.

- Seamless Integration: Our services include guidance on how to effectively integrate chosen apps into your existing systems for a smooth and efficient operational flow.

- Ongoing Support and Updates: We offer continuous support and advice, ensuring that you make informed decisions and effectively utilize the loan apps in UAE for long-term success.

Conclusion:

In summary, leveraging customized instant loan apps in UAE is a strategic move that can significantly enhance business operations by offering tailored solutions aligned with specific needs. Ensuring that an quick cash loan app provides the necessary features, usability, security, and integration capabilities is crucial to maximizing operational efficiency and achieving long-term success. By adopting a meticulous approach to evaluating and implementing the right solutions, a business can optimize its financial processes while maintaining a robust security posture. With ongoing support and insights, businesses are well-positioned to thrive in a competitive financial landscape.

Frequently Asked Questions About Instant Cash Loan Apps in UAE

1. What are instant cash loan apps in the UAE?

Instant cash loan apps are mobile applications and digital platforms that allow UAE residents and expats to apply for personal or short-term loans quickly with minimal paperwork. These apps provide rapid approval and direct disbursement of funds, often within hours or minutes of application.

2. How do instant cash loan apps work?

Instant loan apps typically require:

-

Basic identity documents (e.g., Emirates ID)

-

Proof of income or salary

-

A short digital application process

Once submitted, the system verifies eligibility, approves the loan, and disburses funds electronically, often on the same day.

3. What are the best instant cash loan apps available in the UAE?

Popular instant loan apps and platforms in the UAE include options from major banks and digital lenders such as Emirates NBD, CashNow, FinBin, Mashreq, RakBank, ADCB Hayyak, Liv Bank, EZ Money, and other fintech solutions providing quick financing.

4. Are instant cash loan apps in UAE safe and regulated?

Yes, many reputable loan apps in the UAE operate under licensed financial institutions or fintech regulations enforced by the Central Bank of the UAE. Users should check for proper licensing and data privacy protections before applying.

5. How quickly can I get a loan through these apps?

Depending on the app and your eligibility, approval and disbursement can occur within minutes to a few hours after submission. Some platforms offer same-day funding for approved users.

6. What loan amounts are typically offered through instant cash loan apps?

Loan amounts vary by provider. Examples include:

-

Smaller short-term loans: AED 200–AED 5,000+

-

Mid-range personal loans: AED 5,000–AED 50,000+

-

Larger bank-linked loans: up to AED 150,000+ or more

Rates and limits depend on the provider, credit profile, and eligibility criteria.

7. What costs or interest rates should borrowers expect?

Interest rates and fees vary widely between lenders. For example, some instant loans charge interest rates on an annual percentage rate (APR) basis, while others may include processing fees. Always review the rate breakdown before committing.

8. Can expats apply for instant cash loan apps in the UAE?

Yes, many loan apps in the UAE accept applications from expatriate residents, provided they meet eligibility criteria such as a valid Emirates ID, visa status, and minimum income requirements as specified by the provider.

9. How do I choose the best instant loan app in the UAE?

Consider the following when choosing an app:

-

Loan amount limits and flexibility

-

Approval time and speed of disbursement

-

Interest rate and fees

-

Eligibility requirements and documentation

-

User reviews and reputation of the lender

Comparing multiple apps helps you find the best fit for your financial needs.

10. Can I build my own instant loan app for the UAE market?

Yes. To build an instant cash loan app, you need:

-

Compliance with UAE financial and fintech regulations

-

Secure KYC and identity checks

-

A scalable backend to process applications

-

Payment gateway and disbursement integrations

-

Risk-assessment and credit-scoring systems

A professional fintech app development company can help design, develop, and launch a compliant loan application platform.

11. What features should a good instant loan app include?

Essential features include:

-

Digital KYC (Know Your Customer)

-

Quick eligibility check

-

Secure payment disbursement

-

Flexible repayment options

-

Loan calculator

-

Notifications and reminders

These improve user experience and reduce friction in the lending process.

12. Is it legal to use instant loan apps in the UAE?

Yes, as long as the loan app operates under UAE financial regulations and follows Central Bank guidelines for lending, anti-money-laundering (AML), and data protection. Borrowers should verify compliance before applying.

13. Why should you choose instant loan applications?

Instant loan applications offer a faster and more convenient way to access financial services, reducing the time and effort required for traditional loan processes. This translates to increased efficiency, improved customer satisfaction, and potentially higher profits for businesses.

14. How do UAE-based fast loan apps in UAE operate?

UAE-based fast loan apps in UAE operate similarly to traditional loan processes, with the added benefit of online accessibility and faster processing times. Generally, users can apply for loans through a mobile application or website, submit required documents electronically, and receive funds in their designated bank account within a few hours.

15. Are UAE-based rapid loan apps allowed in the UAE?

Yes, UAE-based rapid loan apps are allowed in the country as long as they comply with applicable regulations and have obtained necessary licenses from relevant authorities. Additionally, it is important for users to carefully review the terms and conditions of a loan app before applying to ensure their rights and responsibilities are protected.

16. In the UAE, what are the requirements for using rapid loan apps?

The specific requirements for using rapid loan apps may vary depending on the app and its policies, but generally, users must be at least 21 years old with a valid Emirates ID and have a stable income. Some loan apps may also require additional documents such as bank statements or proof of employment. It is important to carefully review the requirements of each loan app before applying.

17. What are the UAE’s immediate loan interest rates?

The immediate loan interest rates in the UAE can vary depending on factors such as the borrower’s credit history, loan amount, and repayment period. Some rapid loan apps may offer lower interest rates compared to traditional banks due to their online operations and streamlined processes. However, borrowers need to compare different loan options and consider all associated fees before making a decision.